PRODUCTS AND SERVICES

Revenue models: how the bottom line will move in payments

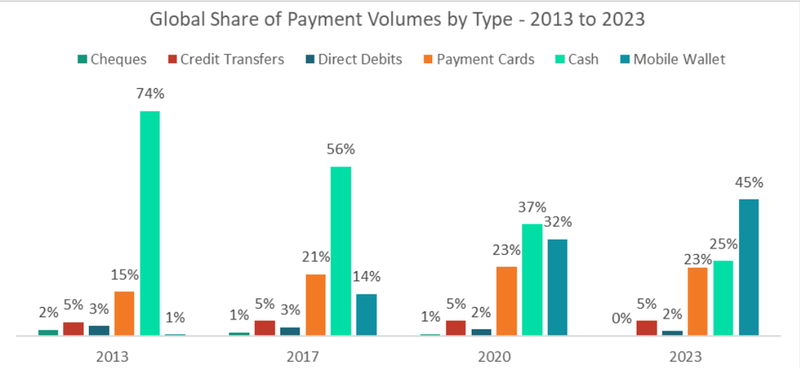

On a global level, the decline of cash is dramatic with APAC leading the global shift towards mobile payments. As Sam Murrant argues, overall, this is good news for the payments industry – cash is costly, while electronic payments make money

A

PAC is the engine driving up global mobile payment volumes. There is growth in Europe/NA, but the market is comparatively tiny. The strength of cards in Western economies is keeping the traditional value chain relevant into the short/medium term.

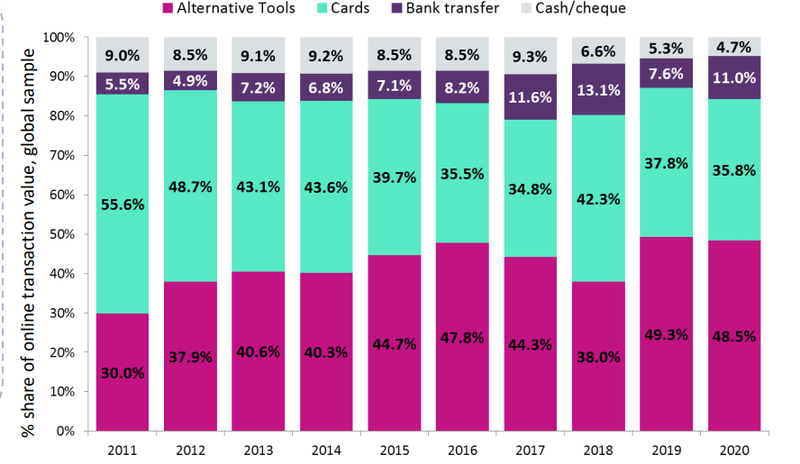

Consumers’ payment tool preference online is increasingly shifting away from cards. And the shift to alternative tools is making for a more fractured market, requiring large processors as partners for merchants. This shift also means revenue streams are moving away from traditional card -based models.

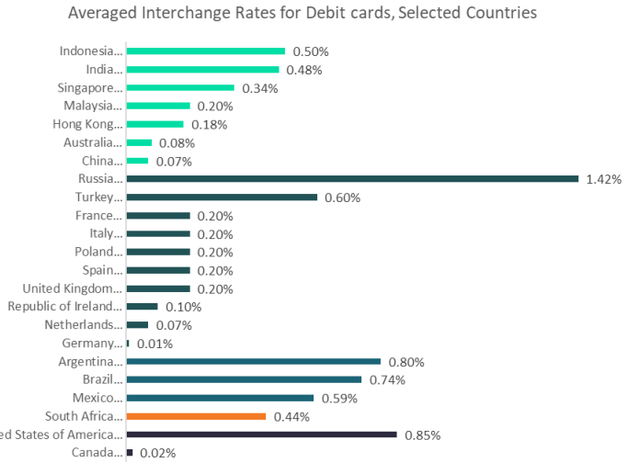

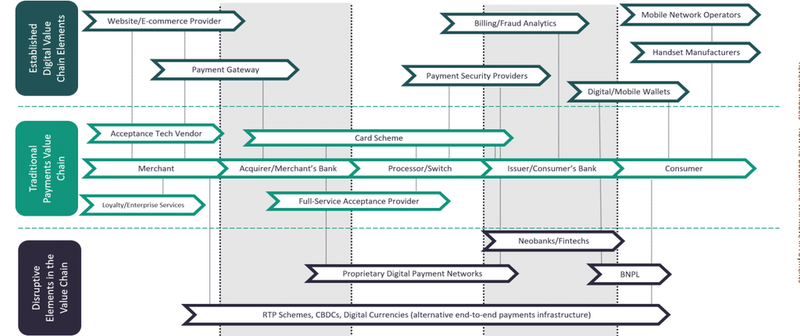

The payments value chain in 2021 has expanded far beyond the traditional players. Interchange is now capped in most global regions and national card schemes are lowering average interchange even further. Yet revenue from interchange is nonetheless growing thanks to the overall growth of the cards market. However, in the current model, issuers are reliant on cards specifically being high-volume and high-growth.

Mobile wallets are a brand disintermediation threat, not a threat to revenue – for now.

So far, uptake among consumers in the developed world is lower than in the developing world in general. As a result, APAC dominates in mobile payment transactions (especially due to China).

Most mobile wallet transactions – especially in the West – are also card transactions (though the card brand is hidden behind the wallet brand). However, they don’t have to be – and as more alternative infrastructure is developed, players like Apple, Tencent, and others will move to include new methods of payment.

Source: GlobalData

Source: GlobalData

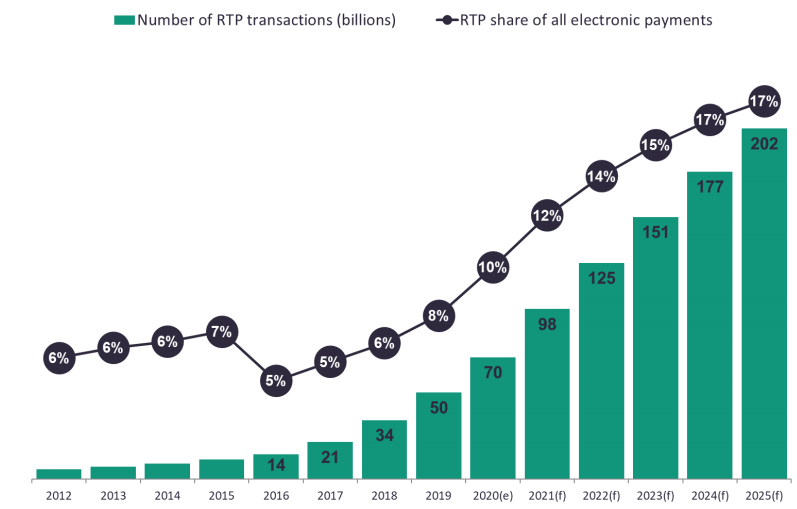

The threat to current revenue streams will come from RTPs and CBDCs

Real-time payment (RTP) transactions are on a sharp upward trajectory. Most countries now have or are developing an RTP system. The disruptive potential here is huge, because an RTP system bypasses the card-based chain entirely.

CBDCs have similar potential but are at a much earlier stage of development. The digital yuan will be the big test case for CBDCs.

Source: GlobalData

Source: GlobalData

Source: GlobalData