PRODUCTS & SERVICES

Better late than never: Tesco Bank launches digital rewards and budgeting features

In the last month, two UK supermarkets have launched reward schemes: Tesco Bank’s “Clubcard Pay” and M&S Bank’s “Club Rewards.” GlobalData banking analyst, Jaimini Pattani, writes

G

lobally, we have seen a trend with other supermarkets aiming to enter the banking space by combining rewards and money management tools.

One example is Walgreens, which recently revamped its customer loyalty strategy with vital elements to its model, including partnerships and a digital strategy to a very niche target audience looking to build rewards around health and wellbeing.

According to GlobalData’s 2021 Banking and Payments Survey, supermarkets/retailers were the least preferred financial services providers among respondents. In our view, this comes as no surprise given the minimal benefits offered by these providers, but recent developments could see potentially successful growth strategies in the space.

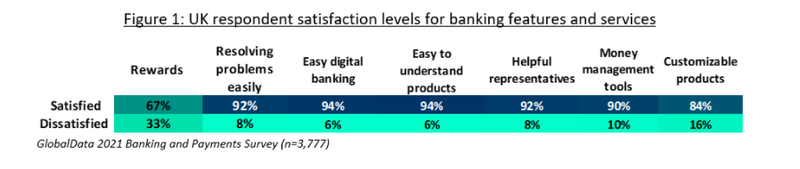

GlobalData’s research also suggests that loyalty and rewards have one of the highest levels of dissatisfaction in comparison to other attributes (figure 1), which indicates a gap in the market for FS providers to improve their personalised loyalty schemes, and it seems as though supermarkets such as Tesco are in front of incumbents in doing so.

Source: GlobalData

Tesco Bank “Clubcard Pay”

Tesco Bank in the UK is in a trial phase of its “Clubcard Pay” card, which is only available to Tesco Clubcard holders (c. 20 million Clubcard households as of April 2021). It is not a current account (i.e., there is no option to set up overdrafts or direct debits). Its main purpose is to help with budgeting and grocery management and to help customers maximise their Clubcard points. So, it is essentially a pre-paid debit card that can be used anywhere that Visa debit cards are accepted once the user has topped up money on it from any other UK bank.

Customers can collect the typical one Clubcard point for every £1 spent in Tesco and for every £8 spent outside Tesco (i.e., other retailers). One of the signup perks is that card holders can collect two Clubcard points for every £1 spent using their Clubcard Pay debit card in-store and online in Tesco and on Tesco Fuel for the first three months.

Although not wholly unique in the market, when customers spend using their Clubcard Pay debit card, Tesco rounds up the amount to the nearest pound and saves the change in a Round-Up Savings Account on the app. So, while the features and characteristics are not too innovative, it is our view that this will be extremely popular, and given the simplicity of the scheme, Tesco’s customised reward programme, is likely to be followed by other supermarkets in the UK.

Concurrently, incumbent banks will likely cut back or generally lack the ability to provide personalised loyalty programmes due to the pandemic and cost-cutting strategies.

Overall, Tesco’s large existing Clubcard customer base, straightforward rewards scheme, and money management tools equate to being realistic and practical. By linking grocery shopping and fuel spending (one of the most significant outgoings for families in the UK) with a spending card that is easily managed through an app, supermarkets are in a strong position versus traditional banks.

Tesco Bank has moved away from replicating the products that banks offer, such as mortgages and credit cards, in favour of a money management/reward proposition, something it can compete better with.

In 2019, Tesco Bank sold its mortgage portfolio to Lloyds Bank in light of “challenging market conditions”, suggesting that the bank was aiming to move away from home loans and look towards new strategies with its existing customer base.

Tesco Clubcard Pay illustration. Source: Tesco