PRODUCTS & Services

Bank loyalty programmes will help travel sector recover

It has been a tough 18 months for most industries but even more so for the travel sector. Covid-19 put a halt on international travel for most, meaning airlines and hospitality businesses suffered significant drops in revenue. Evie Rusman looks at how bank rewards can help the recovery process

A

scenda’s latest report looks at how bank loyalty programmes are fuelling the return to travel, with travel activity expected to reach pre-pandemic levels.

The report outlines that frequent flyer schemes were one of the early heroes of the pandemic, providing revenue continuation for airlines due to their external accrual partners, who buy airline miles on an ongoing basis to reward their customers.

In addition, carriers realised the importance of loyalty programmes for the securitisation of massive stimulus packages, such as the ones taken on by the major US carriers.

According to Ascenda, the largest buyer segment for frequent flyer currencies is banks and card issuers, which use the miles as regular rewards on co-branded cards and for the transfer of proprietary bank points to airline programmes.

Many banks are also letting customers convert points into frequent flyer miles or hotel points.

“Exchanging one’s bank points into frequent flyer miles is hence an active validation of the perceived value of the airline’s reward currency,” notes the report. “This makes transfers a relevant leading indicator for consumer confidence in the travel recovery.”

Ascenda’s Transfer Network is the world’s largest back-end platform powering loyalty currency exchange for banks into airline and hotel loyalty programmes. It enables banks across 40 markets to connect with 50 major airlines and hotel chains.

Source: Ascenda

Transfers

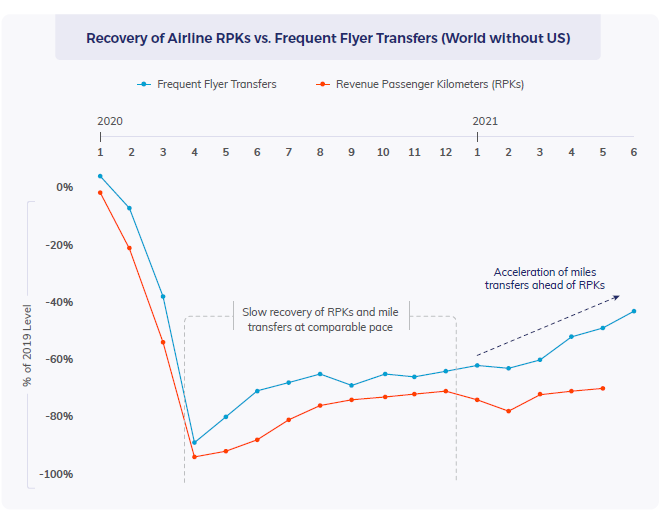

The report shows that frequent flyer mile transfers and revenue passenger kilometres (RPKs) fell similarly in March and April 2020, dropping 90% in comparison to the same period in 2019.

This was caused by global uncertainty surrounding the pandemic. It also stopped people using miles to plan upcoming trips.

However, these rates slowly but gradually started to recover throughout the remainder of 2020 as mortality rates dropped and vaccines were developed. Both metrics finished December 2020 at 60-70% below the previous year.

Ascenda reports that the turning point came in 2021. Due to lockdowns and continued border restrictions, RPKs stalled. Despite this, miles transfer activity began to accelerate.

“With vaccines getting deployed increasingly rapidly and countries such as Israel demonstrating how to open up safely, travel anticipation has clearly been building ahead of the American and European summer period,” says Ascenda.

By June, frequent flyer mile transfers had recovered by more than 50% of pre-pandemic levels.

Source: Ascenda

US market

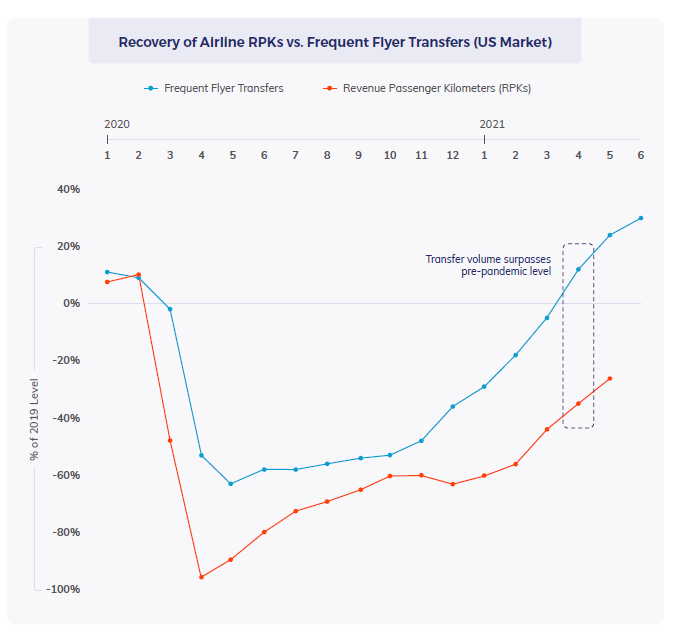

RPK recovery and the rise in transfer activity are particularly pronounced for the US, which offers a large domestic travel market. Furthermore, the US has been very successful in its vaccine roll-out, and as of 9 July had administered 328 million vaccine doses.

Ascenda suggests the vaccine roll-out has caused an increase in consumer confidence, and as a result frequent flyer mile activity has been gradually rising since the beginning of the year.

In April 2021, flyer mile activity reached pre-pandemic levels for the first time. “The data demonstrates that a return of US passenger numbers to 2019 levels is within reach sooner than previously anticipated,” the report notes.

Loyalty programmes

Ascenda’s TransferConnect also provides banks with access to hotel chain programmes. The data shows that hotel chains have capitalised on the pandemic to grow their engagement with loyalty programme members.

According to Ascenda, transfers into hotel points naturally gained relative share as consumers were forced to opt for local vacations. In January 2020, hotel points represented less than 10% of currency transfer volume. Fast forward three months to April 2020 and hotel points tripled their share to 30%.

The report adds: “Change has persisted during the recent months of accelerated recovery, with hotel points transfers having stabilised at approximately 20% of the overall transfer market – double the pre-pandemic figure.”