RESEARCH

PayNearMe: US consumers struggle to pay bills

New research from bill payment platform PayNearMe has revealed that US consumers struggle to pay their bills and demand faster payment experiences. Evie Rusman writes

T

he study, How Consumers Pay Bills: Expectation vs Reality, surveyed 2,676 US consumers aged 18 or over, revealing that nearly one in three (29%) find paying bills stressful.

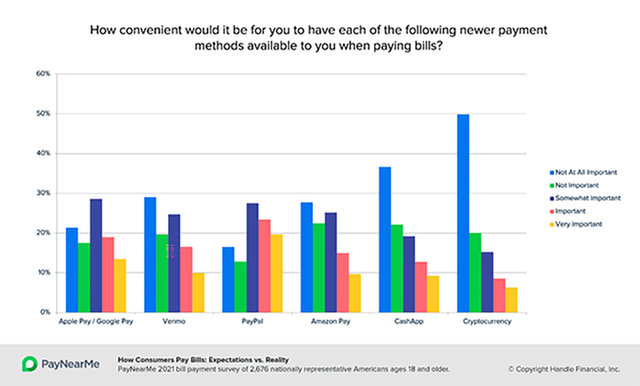

Meanwhile, 38% of consumers said, if they had the option, they would be likely or very likely to use Apple Pay or Google Pay to pay bills.

This comes as Covid-19 has accelerated the move to digital payments, with more consumers using new methods, such as contactless and mobile wallets.

Anne Hay, head of PayNearMe’s consumer research initiative, tells EPI: “Payment innovation in the e-commerce space has upped the ante on bill pay. Today’s e-commerce experiences are fast, easy and frictionless. For example, with technologies like facial recognition, consumers never have to login or remember a password to make a payment.

“Too many consumers are struggling with the cumbersome bill pay experience and it’s stressing them out. Paying bills doesn’t have to be so hard.”

According to PayNearMe, lack of funds is not the reason consumers struggle. The research highlights that disorganisation is the main reason; 48% said they feel disorganised when trying to manage their bills, leading to late and missed payments. In addition, more than half of adults (51%) paid at least one bill late during the past 12 months.

Furthermore, 52% of consumers said remembering passwords, logins and account numbers makes paying bills difficult.

Greater convenience

PayNearMe’s research further revealed that consumers demand more convenient bill payment methods. Hay adds: “If given the opportunity, 42% of consumers would be likely or very likely to use their digital wallet to store, view and pay their bills from a single place.”

Consumers also want more mobile-friendly options for how and when they pay their bills. For example, nearly half of US consumers (43%) say the convenience of using PayPal to pay bills is important or very important, and 38% say if they had the option, they would be likely or very likely to use Apple Pay or Google Pay to pay bills.

Source: Handle Financial

Into detail

Speaking to EPI, Hay discussed the findings in more detail.

Greater convenience

n May, PayNearMe announced a partnership with supermarket giant Walmart, allowing customers to facilitate cash payments for bills through the Green Dot Network at participating Walmart stores.

To pay bills at participating Walmart stores, customers simply show an associate at the Money Services or Customer Service desk the scannable code on their smartphone, pay with cash and collect a receipt that confirms the payment is completed. Funds are then transferred to the biller electronically through a single consolidated settlement.

Michael Kaplan, chief revenue officer and general manager at PayNearMe, says: “Nearly a quarter of the US population prefers – or needs – to pay their bills in cash, and when these individuals can pay their rent, car payments and utility bills in the same location where they shop, paying bills on time becomes easier and more convenient. We’re excited to offer more PayNearMe locations for consumers to make cash payments.”

After partnering with Walmart, PayNearMe’s cash network now surpasses 31,000 retail locations.

PayNearMe expects to launch additional retailers in the Green Dot Network through the expanded partnership, servicing PayNearMe clients across all vertical markets.

Brandon Thompson, EVP of retail, tax and PayCard at Green Dot, explains: “We are always looking for opportunities to deliver modern and seamless banking and money management solutions that create exceptional experiences for our customers and partners.

"We're proud that millions of Walmart shoppers can now pay bills with cash in store, an essential offering for this customer made easier by our partnership with PayNearMe.”