Research

The journey to a cashless world

The idea of a cashless society has been threatening to take the world by storm for a number of years. Although, with countries at varying stages, it may be some time before cash is no more. Evie Rusman writes

N

ew research from GlobalData shows that the journey away from cash differs between markets - In the most developed regions, payment cards dominate cashless transactions, whereas in developing economies, consumers are switching from cash to mobile payments.

Mobile payments are extremely popular in developing countries due to a large proportion of the population being unbanked. In these countries, many consumers do not have the documents needed to open a bank account, so mobile money is a good alternative.

For instance, mobile money transfer service M-Pesa changed the game when it launched in Kenya in 2007. It allowed the financially excluded to send and transfer money for the first time. By the end of its launch year, M-Pesa had over 1.2 million customers.

Asia-Pacific

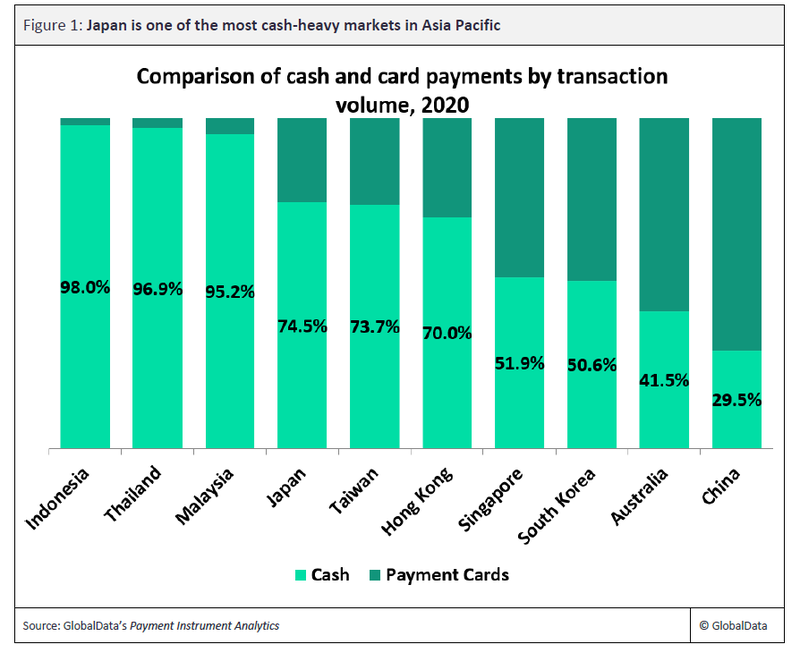

GlobalData’s report, The Cashless World, reveals that in the Asia-Pacific region consumers are leapfrogging from cash to mobile payments, bypassing the use of payment cards.

Despite advancements towards a cashless society, many countries within the region still have a strong preference for cash. Meanwhile, in other markets, consumers are accustomed to non-cash payments.

In most other cases, the cashless payment journey is being limited by aspects of the payment environment, such as the lack of proper digital payment infrastructure or the lack of internet connectivity.

The report shows that the level of cash use varies between Asia-Pacific markets. More in line with Europe and North America, Australian consumers are accustomed to making payments via card. In addition, only 41.5% of payment transactions in the country are made using cash.

Japan is a market that favours cash, with 74.5% of payment transactions carried out using cash. This is surprising for a country that is so technologically advanced. Although, consumer attitudes appear to be the driver of cash.

The report notes: “Japan is not a country that lacks the capabilities to drive cashless payments. But for the most part, Japanese consumers still view cash as the safest, most instant payment method.”

China deserves a significant mention as it is the country least reliant on cash, which only accounts for 29.5% of transactions. This was not always the case though – in 2012, China was still predominately cash-based. However, the introduction mobile wallet AliPay in 2013 saw a dramatic shift from cash to mobile payments.

In countries such as Indonesia, Thailand and Malaysia, cash still dominates, accounting for 98%, 96.9% and 95.2% of transactions respectively.

GlobalData predicts that there will be a big opportunity for mobile payments in Asia-Pac in the coming years.

Western economies

Unlike in Asia-Pacific, most Western economies have been undergoing a cashless journey for the last few decades. Yet even in this region, adoption varies significantly.

Similar to Japan, Germany still favours cash, which accounted for 46.8% of overall payment transaction volume in 2020, compared to a 14.4% share for payment cards. This was essentially the reverse of the UK – cards accounted for 56.2% of transaction volume while cash accounted for 16.0%.

Why is this? According to the report, the UK is one of the leading markets when it comes to cashless payments, with the first credit card being introduced during the 1960s.

Although it wasn’t until the late 1990s and early 2000s that cards started to be regularly used for payments as this is the time POS terminals became popular. This fuelled the move away from cash.

In addition, 2012 saw a nation-wide rollout of NFC terminals, popularising contactless cards. The report notes: “UK consumers now feel comfortable using payment cards and other electronic payment methods for day-to-day, recurring transactions.”

GlobalData argues that growth in the payment card market over the past five years has been driven by the rise of contactless payments, a surge in debit card payments, and the increasing use of mobile wallets.

The speed at which this is happening has caused concern amongst industry observers, with some saying there could be increased risks for demographics reliant on cash.

Sweden

Sweden is another country which is advanced in terms of payments and by 2023 is expected to reach a completely cashless society.

GlobalData’s research shows that average monthly card payment volume is higher in Sweden than in other mature European markets such as the UK and Germany.

“Sweden’s affordable and widely available financial products, the strong presence of alternative payment methods, and the consumer preference for electronic payments have driven Sweden to become a less cash-dependent society than many of its peers,” notes the report.

US lags behind

The US was the earliest inventor of cards, introducing them in the late 1950s. Despite this, the country is now lagging when it comes to cashless.

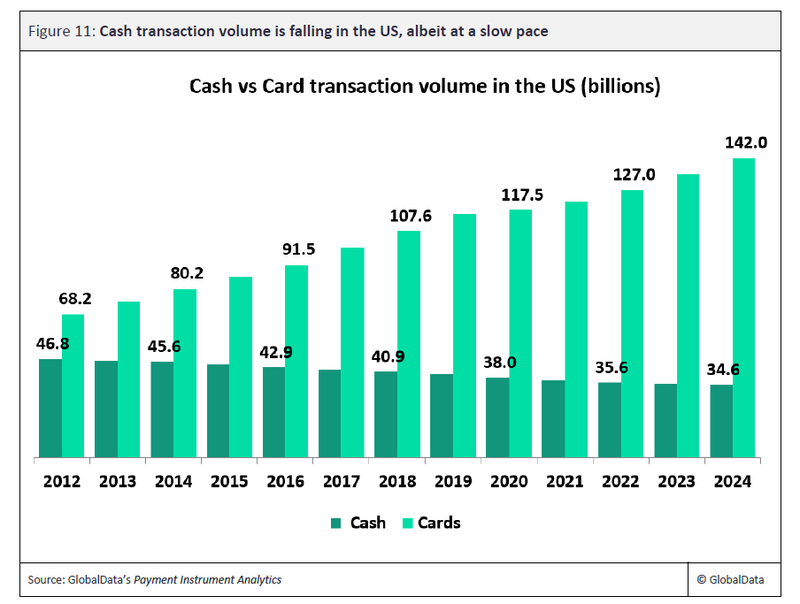

And while payment card transaction volumes are increasing and cash volumes are declining, the pace of change is quite slow.

GlobalData suggests that reasons for this could be due to large segments of the population still being unbanked and are therefore reliant on cash. In addition, the US has been slow to roll out NFC-enabled POS terminals across its vast geography.

There has also been pushback against the cashless trend. Activists and lawmakers in the US argue that a cashless environment is not fair to unbanked individuals.