PRODUCTS

Hyundai Card blazes innovative PLCC trail in Korea

Private label credit cards are emerging as an area of strategic focus for credit card issuers in Korea and Hyundai Card believes it is blazing a trail for innovative use of PLCCs. With products launched with 12 industry champions including Starbucks, CostCo, Korean Air, Hyundai, Kia and MUSINSA, Hyundai Card is investing much time, energy and money in pursuing market share gains via the PLCC route, writes Douglas Blakey

A

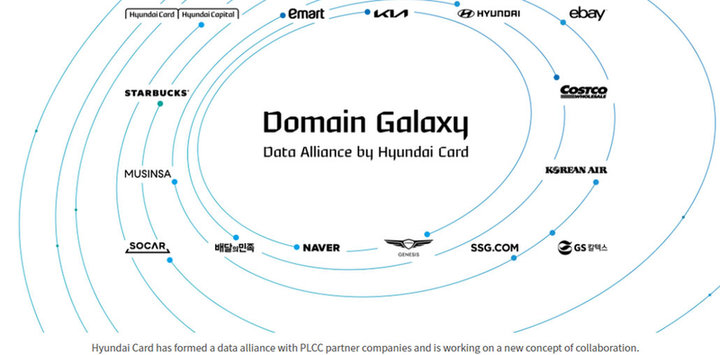

s if comprehensive product roll outs and multiple marketing partnerships was not enough to be going on with, Hyundai Card is flagging up its fintech credentials by establishing a “Domain Galaxy: Data Alliance by Hyundai Card” with its private label credit card partners.

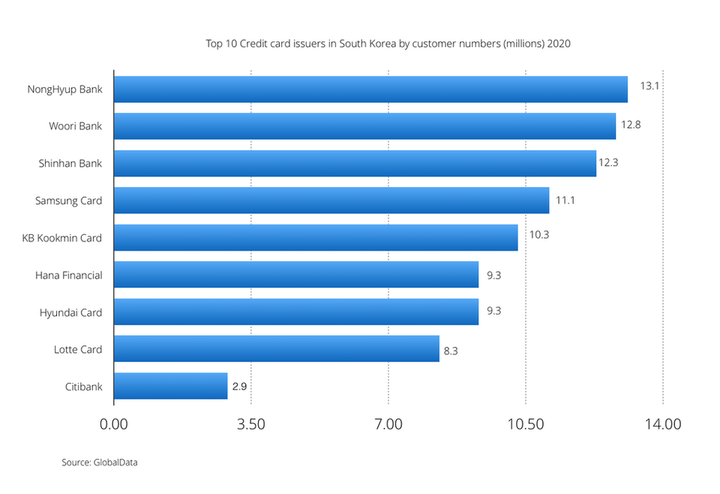

Hyundai Card is on a roll. By the end of 2020, total customer numbers for the Hyundai credit card increased by 7% year-on-year to 9.26 million. That means that Hyundai Card now ranks equal sixth in South Korea with Hana Financial and behind only NongHyup Bank, Woori, Shinhan Bank, Samsung Card and KB Kookmin (see table).

Hyundai Card’s financial performance also improved markedly. The card unit recorded an operating income of KRW32.8bn won last year, an increase of 51% year-on-year, boasting the fastest growth in the sector.

Hyundai Card credits its market share gains and improved financial performance, in part, to its innovative and sector leading pursuit of private label credit card deals.

Moreover, it believes that its growing portfolio of PLCC deals gives it the potential to win additional market share.

Top 10 South Korean credit card issuers

Last year, Hyundai Card intensively launched PLCC products in cooperation with Korean Air, Starbucks, and Baedal Minjok (Baemin).

Until last year, most of the credit card companies in Korea except Hyundai Card did not handle PLCC. But now all seven of the largest Korean credit card issuers offer PLCC products.

Credit card issuers are partnering with retailers popular among millennials and Gen Z to launch PLCC products. In the face of increased competition with the big tech companies’ entry into the financial market, the PLCC market is expected to continue to expand. That means that competition is set to intensify as the credit card sector tries to secure new revenue streams.

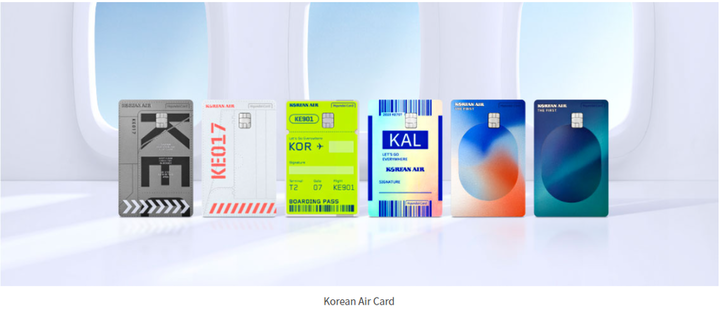

Korean air card. Image credit: Hyundai Card

Hyundai Card partners with 14 major brands

Hyundai Card launched Korea's first PLCC “E-mart e card” in May 2015 and then formed a PLCC partnership with Hyundai Motor and Kia Motors in 2017. Then followed eBay Korea in 2018 as well as Costco, and SSG.COM, an e-commerce company affiliated with Shinsegae Group, in 2019.

By the end of 2020, Hyundai Card had partnered with 10 different companies for its PLCC series. And now, Hyundai Card has launched or is preparing to launch more PLCC products with 14 major brands including SOCAR, MUSINSA, Genesis, and NAVER.

GlobalData estimates that credit cards account for a market share of 40.1% of payments by transaction numbers in South Korea against 59.9% for debit cards. But credit cards lead the way in terms of payments value – accounting for 78.7% of card payment transaction value in 2020.

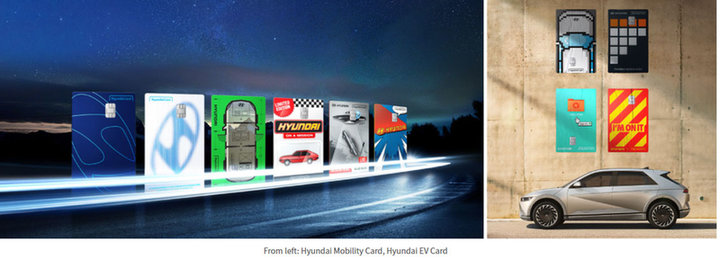

Hyundai mobility card and EV Card. Image credit Hyundai Card

S Korea credit card penetration: 218 cards per 100 individuals

Credit and charge card penetration in South Korea stands at 218.0 cards per 100 individuals in 2020 – third highest in the region compared to Hong Kong (259.4), Japan (231.6), Taiwan (209.0), Singapore (161.4), Australia (74.2), China (58.2), New Zealand (57.0), and India (4.6).

Credit and charge card payment frequency in South Korea is estimated at 136.2 transactions per card per year in 2020, much higher than the figure for debit cards (54.0). By comparison, other markets in the region, according to GlobalData include credit card transactions per year of New Zealand (194.3), Australia (157.8), China (66.0), Singapore (65.9), Japan (46.8), Hong Kong (42.2), India (38.6), and Taiwan (26.2).

The trend for South Korean consumers to use their credit cards for higher value transactions will continue with issuers continuing to incentivise usage. For instance, Shinhan Card offers Shinhan Card D-day, which provides 5% of the transaction value as My Shinhan points for spending in specific segments on certain days of the week, such as movie tickets on Thursdays or online shopping on Sundays.

For its part, Hyundai Card believes that it will win additional market share by its PLCC strategy, combined with an innovative data strategy,

Starbucks hyundai card image. Credit: Hyundai Card

Domain Galaxy: Hyundai Card’s data alliance

Specifically, it has partnered with 14 major industry leaders to form a group dubbed “Domain Galaxy” and provides a data-based marketing platform service called “Galaxy North” to the group members.

Hyundai Card is already operating “True North,” a data platform that provides marketing promotions such as coupons by selecting customers who have strong marketing prospects for Hyundai Card customers.

Hyundai Card believes that PLCC and data science are inseparable. Domain Galaxy members providing marketing benefits through Galaxy North are able to reduce their advertising costs and instead invest the savings into developing customer benefits.

This year, six marketing promotions have been completed through Galaxy North, with four additional promotion projects scheduled. One of the promotion campaigns was requested by SOCAR, Korea’s largest car-sharing service provider. It wanted a detailed customer segmentation analysis. The promotion was to provide discount coupons to petrol station chain GS Caltex’s customers who reside in the Metropolitan area and use the GS Caltex’s smart refuelling service at least four times a year.

Socar Card image. Credit Hyundai Card

Super customisation

A Hyundai Card spokesperson tells EPI that its innovative use of data science will offer “super customisation.” In the past, segmentation marketing has focused on classifying customers by criteria such as gender and age. With super customisation, it is possible to provide customised services optimised for each individual based on analysis of customers’ consumption behaviour. Domain Galaxy's goal is to establish a unique data alliance that enables strong cooperation among members of different business fields, customers, and interests through Galaxy North. In addition, Domain Galaxy will serve as a catalyst for the growth of each partner.

Baemin Hyundai Card image. Credit Hyundai card

Notable Hyundai Card PLCC deals

Hyundai Mobility Card and Hyundai: Hyundai Mobility Card and Hyundai EV Card, were rolled out jointly by Hyundai Card and Hyundai Motor. Rewards of both cards centre around “BLUEmembers points,” a reward system for Hyundai Motor customers, when buying and maintaining Hyundai motor vehicles and spending at various shops affiliated with the reward system. The Hyundai Mobility Card offers bigger reward points when cardholders pay for gas, car maintenance and cleaning and spend on public transport and car sharing services, while the Hyundai EV Card focuses on maximising reward benefits for charging electric and hydrogen vehicles.

Image from Hyundai. Image credit Hyundai Card

MUSINSA Hyundai Card: MUSINSA Hyundai Card is the first MUSINSA-branded credit card and is also the first PLCC with a local fashion-focused e-commerce platform.

MUSINSA is Korea’s 10th unicorn online fashion platform with 8 million registered users and 5,700 brands. Almost 70% of its customers are teenagers and those in their 20s, an indication the store has an avid fan base among millennials and Generation Z. The MUSINSA Hyundai Card offers a 5% discount on payments made at “soldout,” an online market run by MUSINSA that sells limited-edition fashion items.

SOCAR Card: In January 2021, SOCAR and Hyundai Card unveiled the SOCAR Card, a credit card with exclusive benefits for users of the car-sharing service. This is the first time that a mobility service launched a PLCC in Korea. SOCAR Card users receive exclusive benefits, while paying for the car-sharing service with the credit card offers cash-like rewards called “SOCAR credits.

Baemin Hyundai Card: The Baemin Hyundai Card centres around “Baemin Points,” cash-like rewards for use within the Baedal Minjok food delivery app. When a Baemin Hyundai Card subscriber registers the card with the payment app, every 3% of spending is returned in the form of Baemin Points. The 3% reward is given on top of the default 0.5% Baemin Points for using Baemin Pay.

Starbucks Hyundai Card: Starbucks Hyundai Card is the first credit card Starbucks created in collaboration with Hyundai Card. The card comes with extensive reward benefits for Starbuck customers, centred on the Starbucks Rewards programme. The card gives a “Star” reward for every KRW30,000 of expenditure both at home and abroad.

In the six-month period since its launch, Starbucks Hyundai Card has seen the cumulative number of stars accumulated by members hit approximately 12 million. That accounts for about 10% of the 120 million stars accumulated by all Korean Starbucks Rewards members during the same period, a reflection of the instant popularity of the card.

Smile Card: Smile Card is a private label credit card launched by Hyundai Card and eBay Korea in 2018. The card has attracted over 1.1 million subscribers as of April 2021, becoming the first million seller PLCC from Hyundai Card.

Korean Air Card: Hyundai Card with Korean Air jointly launched a credit card designed to offer airline bonus miles and related benefits, in April 2020. The Korean Air-branded private label credit card is the first of its kind in Korea.