RESEARCH

Business payments play an important role in every economy, company and bank

The 2021 Business Payments Barometer from Bottomline Technologies highlights that receiving money has become more important than ever for organisations of all sizes, especially small (67%) and large (72%) businesses. Indeed, some 68% of businesses say receiving money quickly has never been more important, reports Douglas Blakey

A

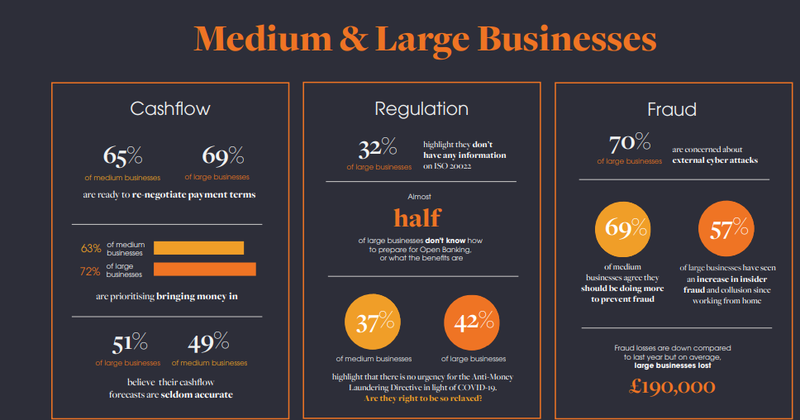

s receiving cash quickly became a top priority over the last year, businesses began to understand the seriousness of the pandemic, which is why two in three businesses were willing to renegotiate payment to help manage cashflow in the light of Covid. However, this is not the case across every size of business. While medium-sized and enterprise-sized businesses are willing to take this approach, small businesses are less likely, with only one in two agreeing.

Cash is king

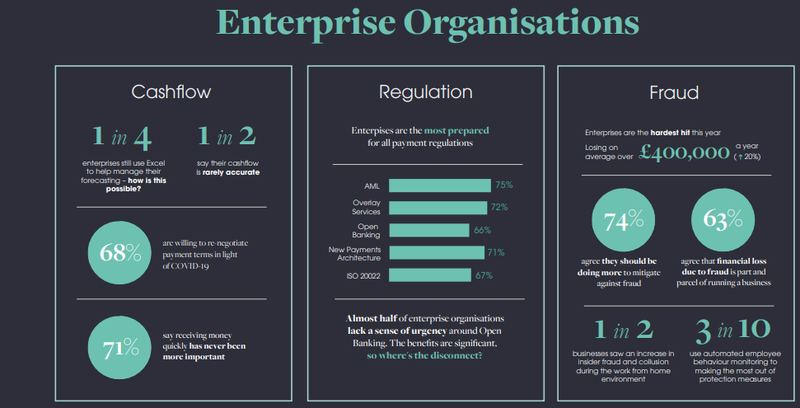

In an uncertain landscape, never has the term ‘cash is king’ been more key to business operation. But, when such a large number of businesses are struggling to provide accurate forecasts regarding their cashflow, how can they be sure what is in the bank? Amazingly, one in three businesses is still manually managing cashflow forecasts in Excel.

This surprising figure includes enterprises, with one in four still using Excel, so there is a worry about whether businesses truly understand their financial position, which right now seems to be on the top of everyone’s agenda. There is a clear opportunity for growth for every size of business in this space.

As businesses shifted to working from home, the scammers came out of the woodwork. Around half of the businesses surveyed for the 2021 Payments Barometer saw an increase in insider fraud and collusion, driven mostly by the large (57%) and enterprise (53%) business sizes.

Source: Bottomline Technologies

Fraud declines for small, medium and large businesses

Fraudsters often take chance of every opportunity. However, it is not all bad news. On the whole there has been a decrease in fraud across the board for small, medium and large businesses.

There is, however, evidence that organisations are stuck in a loop. While this year might be good news for those sized businesses, it is not good news for enterprises, which are facing an all-time high with fraud losses being 20% higher than last year. The report concludes that the only effective way of mitigating evolving fraud risks will be to break this cycle and to truly understand the impact of fraud-protection techniques.

The 2020 Business Payments Barometer noted that businesses were putting tools in place to help protect them from fraud, with 57% of businesses using bank validation. This year this figure dropped to only half of businesses surveyed validating bank data.

The new working from home environment meant a fast switch in how businesses were not only run but how they made payments, meaning not all protection measures were continued in the new working from home environment. But could this have resulting in an increase in fraud? One thing is for certain, the fraudsters took advantage of this situation.

Source: Bottomline Technologies

2021 Payments Barometer: easier access to technology the biggest driver of change

2020 catapulted business change and digitisation years ahead of projections. But did this filter through to the world of payments? In the 2020 Business Payments Barometer, financial-decision makers highlighted easier access to technology as their biggest positive driver of change.

This year’s report notes that large businesses embrace the change upon them by being the most likely sized business to accept new payment types.

Around one in six of businesses surveyed have begun to introduce instalment or buy-now-pay-later solutions. But the report asks if businesses are making the most of innovation in the industry through regulation and initiatives to enhance their offering?

Actually, since 2019 the Business Payments Barometer has highlighted a decline every year in preparedness for payments regulation and that continues this year. Given that the regulations are created in the industry to address fraud and support businesses with cashflow and cash management – the core of challenges highlighted by businesses this year – this becomes problematic from both a regulatory and business perspective.

Businesses are quote often but off by jargon associated with new regulation and initiatives which could possibly highlight why only one third of businesses who listed regulatory changes as a key driver of change see them in a positive light.

Source: Bottomline Technologies

What is important across businesses this year?

The 2021 Business Payments Barometer notes that for small businesses, the most important three factors are: improving cash collection, single platform access, and third equal, mitigating fraud risk and ease of reconciliation. By contrast, medium, large and enterprise businesses report that mitigating fraud risk is the single most important priority.

Paul Fannon, global business solutions MD at Bottomline Technologies, says: “Very few decision makers in the financial space are prioritising the migration to cloud-based technology. This slow adoption is unsurprising if we think that digital transformation can often be a complex and sometimes daunting task. Nevertheless, the shift is no longer just a cost-cutting exercise but something which will see considerable performance benefits for organisations well into the future.”

The need for better forecasting, automated tools

Fannon adds: “Many organisations find themselves in a cycle of reviewing and managing fraud risks successfully one year, only to fall victim the year after. Better forecasting, a focus on liquidity and investing in automated tools which mitigate fraud risk is the only way to address and overcome ever-evolving business challenges.

“While Covid and uncertain trading environments have plunged some of us into a moment of uncertainty, we have also reached a crossroads filled with endless possibilities.”