Products & Services

Payment and settlement in the UK

The Bank of England (BoE) has been acting as a settlement agent for payment systems since the 19th century. Mohamed Dabo looks at the system today

P

ayments are essential to the UK’s economy. Most payments are made through payment systems.

The BoE fills the role of a settlement agent, by enabling financial institutions to make payments to each other.

What is a payment system?

Payment systems are a set of common rules and procedures that support the transfer of funds between people, businesses, and financial institutions.

Most payment systems are managed by operators, and supported by one or more infrastructure providers of hardware, software, and communication networks.

Some financial institutions have direct access to each payment system and provide payment services to their customers.

Why is a settlement agent necessary?

Not all accounts are held at the same payment service provider, so when a customer makes a payment to a business that has an account with a different provider, the customer’s provider owes the business’s provider the value of the payment.

This creates a level of risk, so a payment system needs to use an intermediary, known as a settlement agent, for the final settlement of funds between providers.

Banks and other institutions can hold accounts with the BoE, which are used to settle money moved between them.

The central bank provides these accounts to support its mission of maintaining monetary and financial stability.

There is a financial stability advantage for a settlement agent being a central bank like the BoE.

As the central bank is financially supported by the Government, this removes the risk of account holders losing money held in, or moved between, accounts held with the BoE.

The RTGS and CHAPS services

The BoE operates the real-time gross settlement (RTGS) service, infrastructure that holds accounts for banks, building societies and other institutions.

The balances in these accounts can be used to move money in real time between these account holders. This delivers final and risk-free settlement.

The central bank also operates the Clearing House Automated Payment System (CHAPS).

CHAPS is a sterling same-day system that is used to settle high-value wholesale payments. It also settles time-critical, lower-value payments like buying, or paying a deposit on, a property.

Responsibility for the CHAPS system transferred to the Bank of England in November 2017.

There are over 30 direct participants and several thousand indirect participants that make CHAPS payments through one of the direct participants.

Direct participants in CHAPS include the traditional high-street banks and a number of international and custody banks.

Many more financial institutions access the system indirectly and make their payments via direct participants.

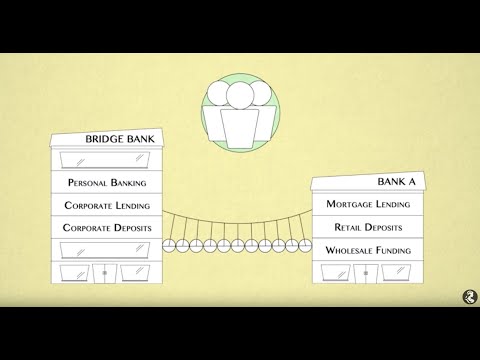

This is known as agency or correspondent banking.

The BoE is the UK’s resolution authority

Banks and other financial institutions can experience periods of financial distress.

The UK, like many other countries, has a resolution regime for banks and certain other types of financial institution.

Resolution is a way to manage the failure of a bank, building society, central counterparty or certain types of investment firm. The BoE uses it to minimise the impact on depositors, the financial system and public finances.

Using resolution to manage bank failure in an orderly way, allows the BoE to maintain critical functions, protect public money, and ensure financial stability.

Why we need a resolution regime

In 2008, banks in many countries were in financial distress. Governments – including the UK’s – felt they had no choice but to bail the banks out.

If a large bank had failed then, it would have caused serious problems for many people, businesses and public services. These banks were ‘too big to fail’.

After the financial crisis, the UK, like many other countries, took action so there would be better options if a large bank were to fail in future.

The UK established a framework for resolution (known as the ‘resolution regime’) in the Banking Act 2009.

Over time, this regime has been improved and expanded. It is consistent with international standards for resolution regimes.

Under the UK’s regime, the central bank is the UK’s resolution authority. The BoE’s job is to work with banks to make sure it can carry out its resolution plans if they fail.

Since 2009, the BoE has used the regime for two firm failures.

What the BoE does if a bank fails

Most UK firms would be put into insolvency if they failed, because that wouldn’t disrupt the economy or financial system.

Eligible depositors in failed firms would either receive compensation from the FSCS within seven days or have their accounts transferred to another firm.

The UK’s resolution regime operates alongside the depositor protection regime.

If a firm’s failure would otherwise result in losses for depositors, the FSCS will protect eligible depositors, up to £85,000. In some specific situations, it can be more e.g., if a depositor has just sold a house.

But the largest or most complex firms could not go into insolvency. The BoE would need to resolve those to protect the UK’s vital services and financial stability.

In these cases, shareholders and certain creditors take the losses.