Regulation & Compliance

Fighting fraud in the wake of the pandemic

Financial crime has accelerated at the hands of the pandemic. This means that it is now more important than ever for banks to invest in sufficient anti-fraud systems. Evie Rusman looks at how the industry can protect consumers

T

urbulent changes over the past year have meant that consumers are more vulnerable to fraudulent attacks, with many fraudsters using Covid-19 to con consumers out of money.

For example, since the UK rolled out its vaccination programme, a number of phishing emails have reached consumers asking them to enter their card details in return for a vaccination slot.

This is just one example of how fraudsters are exploiting consumers. Cyber criminals have also been taking advantage of the amount of time consumers are spending online.

Figures from UK Finance show that £207.8m was lost to authorised push payment (APP) fraud in the first half of 2020. These figures are on par with losses in the same period in 2019.

However, losses to investment scams rose by 27% to £55.5m in the first half of 2020, the largest increase of any scam type.

Katy Worobec, managing director of economic crime at UK Finance, says: “Criminals have ruthlessly adapted to this pandemic with scams exploiting the rise in people working from home and spending time online.

“These range from investment scams promoted on social media and search engines to the use of phishing emails and fake websites to harvest people’s data.”

Omdia report

Adding to this, a recent report from Omdia (in partnership with FICO) says that banks were forced to make dramatic changes to their operational practices with lockdown restrictions, meaning existing fraud measures were not as effective in some cases.

“The pandemic has exasperated the challenges banks have in tackling both AML compliance and fraud, impacting fraud volumes and catalysing higher false positives as existing models struggle to adapt to changing customer behaviour,” the report notes.

In response, regulators are putting more pressure on banks to become more compliant – in 2020, regulators handed out over $10bn in fines, a more than 25% increase on an already significant 2019 figure.

This is not the only driver of compliance - banks also want to protect their customers due to worries around reputational damage.

Priorities

So, how are banks adapting? One of the biggest challenges for banks is finding the balance between protecting the customer and building a strong user experience.

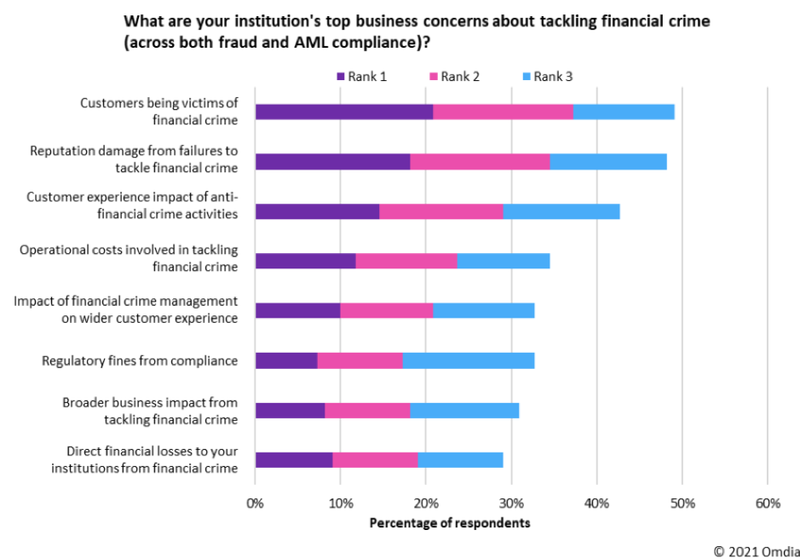

The study shows that the top priorities for most institutions relate to protecting the customer as well as the bank’s reputation, with reputation more important than any direct financial loss. The threat of regulatory fines is a secondary concern.

The other priority for fraud and compliance executives is in ensuring that their financial crime operations provide a strong customer experience. This relates to speed of investigations, and resolution of any suspected fraud.

Fighting Fraud chart. Credit: Omdia

Current approach

Issues caused by the pandemic, such as skilled-staff shortages, have caused banks to question whether their current approach is sustainable.

Omdia suggests the way forward is to drive a centralised approach to financial crime bringing together AML compliance and fraud capabilities, whether this be through a single integrated platform and/or a shared approach to workforce and data resources.

At an organisation level, the reporting lines for fraud and AML compliance are typically separate, with around two-thirds of retail banks surveyed stating that these reported into different business executives.

Compliance tends to report in through compliance and/or risk functions, whereas the organisation of fraud functions is often more varied.

This is set to change - the study shows that 69% of institutions now have strategic plans to integrate functions or share resources between AML compliance and fraud. In addition, 50% have plans to do so within three years.

Artificial intelligence

The report cites artificial intelligence (AI) as a strong driver towards financial crime goals. AI and machine learning (ML) enable banks to rapidly respond to emerging threats by identifying light or hidden signals for financial crime or automated optimisation of detection models.

Furthermore, recent advances have improved the ability of AI to provide decision outcome.

Omdia’s Fraud and AML compliance study in 2019 found that there was widespread interest from both the compliance and fraud sides in using such technologies to tackle financial crime. Over 80% of institutions said they were either using or actively planning to use new techniques.

Despite the huge benefits of AI, Omdia argues that existing platforms are not utilising the technology effectively.

The report notes: “The challenge for institutions is that many of the technology platforms of today are not strong in supporting these new approaches. Particularly weak is the ability to design and deploy machine learning models built in-house, with just over a third of institutions having platforms that effectively support this.”

Platforms struggle in their adaptability, both in deploying new or change strategies and time requirements for upgrades, and in supporting machine learning.

The ability to deploy third party ML models is stronger, however, the ability to support in-house development and deployment of ML models is particularly weak.

“Given that AI and ML is producing significant benefits for institutions in tackling financial crime from a detection and adaptability perspective, as well as operational benefits in cost reduction and reducing false positives, this platform gap is likely to be increasing problematic for institutions unless addressed,” the report adds.

It is evident that there is still a long way to go before banks truly enhance technology as a means to tackle financial crime. Nevertheless, Omdia’s research indicates that the sector is open to change and willing to take the necessary steps to protect its customers.