Strategy

Mastercard Request to Pay launches in UK

Last year, Pay.UK launched its Request to Pay framework as a new flexible way to manage and settle bills between businesses, organisations, and people. This month Mastercard became the first to offer services within this framework. Evie Rusman writes

R

equest to Pay is a messaging service that was created by Pay.UK to complement existing payments infrastructure and gives billers the ability to request payment for a bill rather than simply sending an invoice.

In line with the framework, Mastercard rolled out a Request to Pay end-user application. The solution now builds and enrols end user applications, such as a mobile app for consumers or a corporate IT system.

Andrew Buckley, EVP of product management at Mastercard, says: “Mastercard’s Request to Pay solution has the ability to transform bill payments in the UK. As individuals and businesses all demand faster, easier and more intuitive ways to pay bills, the pressure is on financial institutions to quickly offer innovative solutions.”

The move comes after Mastercard’s 2020 State of Pay report revealed that one in ten people in the UK often forget to pay their bills, resulting in late payments. Meanwhile, one in five say they do not feel in control of the outgoings from their accounts.

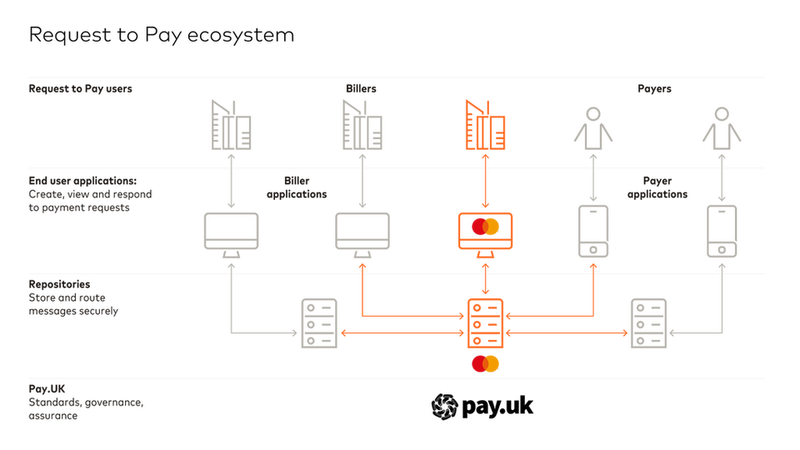

Mastercard Request to Pay Diagram. Credit: pay.uk

How it works

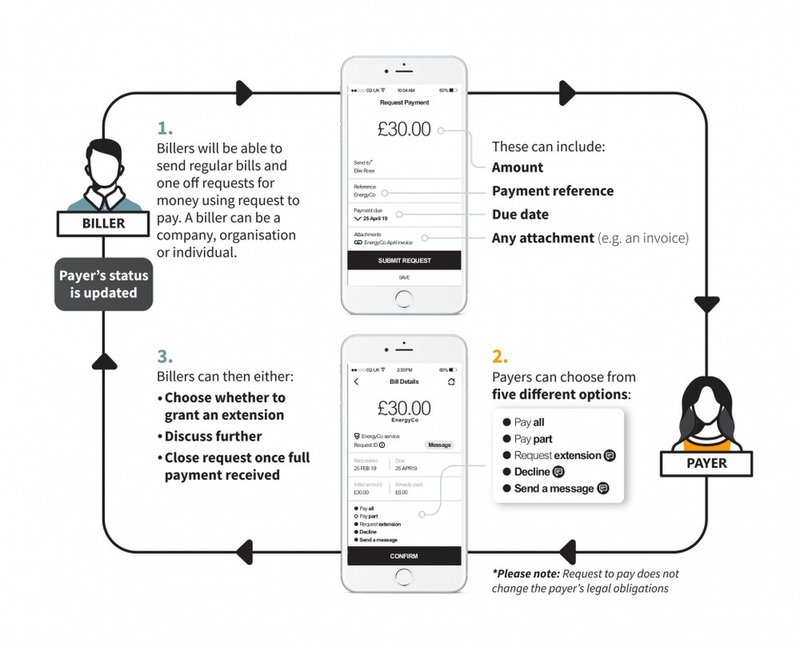

For each ‘request’ made, customers can pay in full, pay in part, ask for more time, communicate with the biller or decline to pay.

To communicate directly with the biller people can use an in-app chat feature, to query an unusual or unexpected bill before the payment is made or make alternative payment arrangements.

In addition, the service can translate the request into a credit transfer once the payer has approved and authenticated it – the aim is to reduce fraud risk and error.

The new service also promises to allow partners – such as financial institutions, fintechs and aggregators – to offer an end user application at a lower cost than if they developed it themselves.

“This extension to our Request to Pay offering provides our partners with a way to accelerate the launch of their own tailored solutions ensuring that they stand out in the sector while being able to benefit from increased customer engagement and additional revenue streams,” says Buckley.

Speaking on Mastercard’s new service, David Piper, Head of Service Lines at Pay.UK, says:“Request to Pay has the power to transform how people pay by putting user choice at the heart of the payment process, providing greater control and flexibility when it comes to paying bills.

“We are delighted to see Mastercard become accredited as both an application and repository provider, and we look forward to the seeing how its solution can support consumers, businesses and financial organisations throughout the UK.

pay.uk diagram. Credit: pay.uk

The journey so far…

In the four years leading up to its launch, Request to Pay underwent research and user proposition testing to ensure that the final Framework met the needs of all the people and organisations that could potentially use it.

The testing was completed with six months of consultation with the industry, followed by a further six-month pilot to validate the framework.

This included testing that messages could be sent across the Request to Pay ecosystem and that payments could be made as a result of receiving a Request to Pay message.

Pay.UK also sought to test the market’s reaction to the framework. In 2018, the company commissioned Ipsos MORI to conduct research with stakeholders including businesses, charities and financial institutions.

Qualitative research then took place in early 2019, comprising roundtable discussions and in-depth interviews focused on sectors with the potential to benefit from the service.