TECHNOLOGY

TreviPay unveils one-click mobile payments app for B2B buyers

TreviPay, previously known as MSTS,has launched its first B2B mobile payments app. Mohamed Dabo reports on an innovation that creates B2C-like transaction simplicity

B

illed as “an industry milestone towards the complete digitisation of B2B payments”, the innovation allows merchants to offer a mobile app payment experience to pre-approved B2B credit customers.

The app allows buyers to access buy-now-pay-later (BNPL) or trade financing in-store via an intuitive mobile app, eliminating the need and fraud risk of issuing multiple credit cards to numerous purchasers within the organisation.

Additionally, merchants can offer instant, digital invoicing within the app to provide their B2B buyers with a simpler experience versus paper receipts and manual invoicing.

Improving payment options, speed and terms has the potential to drive customer and operational benefits.

Leveraging TreviPay’s new white-label app, clients can offer B2B buyers a digital payment experience and BNPL flexibility similar to the B2C purchasing experiences many people have grown to prefer.

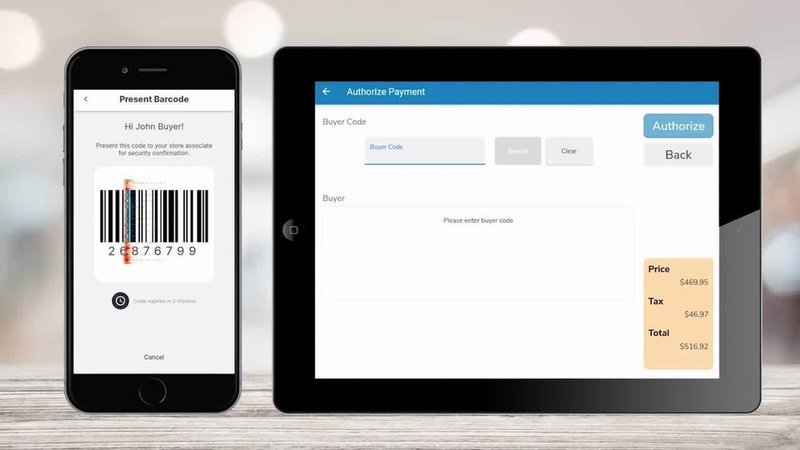

In one click, B2B customers can access their pre-authorised credit line by generating a unique code to be scanned at the POS.

Purchase details and terms are then stored in the app’s convenient purchase history and sent directly to the buyers’ company, offering buyers the same immediate gratification as a contactless B2C transaction.

TreviPay clients can offer B2B buyers a digital payment experience. Image: TreviPay

Recent research conducted with Forrester Consulting showed that more than 60% of payments decision-makers within merchant companies cited their most urgent customer concerns as increased scrutiny on security and fraud prevention, more digital payment options, and more flexible payment terms – all of which are offered through the new mobile application, including two-factor authentication (2FA).

“TreviPay simplifies the complexities of B2B commerce, making it indistinguishable from B2C experiences for the buyer,” says TreviPay CEO Brandon Spear.

“Retailers are facing immense competition in the post-Covid economy, which has amplified the need to offer payment solutions that will drive revenue and customer loyalty.

“Our new mobile app allows one-click access to BNPL, instant invoicing and increased security, so our merchant partners can make it easy for their B2B buyers to pay on their terms, in the channel they prefer and with no need for POS hardware upgrades.”

As contactless, digital payments continue to rise, the TreviPay mobile application can replace the need for physical plastic cards in the growing B2B space where sales are projected to reach $1.2trn in 2021, up from $889bn in 2017.

Additionally, to better attract and retain B2B customers, offering a digitised BNPL solution provides payments flexibility in the sought-after speed and security of a B2C-like experience.

According to the same Forrester research study, more than ninety percent of merchants expect that improving payment options for B2B customers will improve customer satisfaction, speed up transactions, free up internal resources, and increase business success – showing an inherent need for B2B sellers to adapt payments processes.

TreviPay’s first partner of its one-click mobile app solution for B2B buyers is Staples Canada, which is leveraging the new offering in all 305 stores across Canada with an average C$6,500 ($5,178) credit line per user.

Staples’ authorised purchasers are now able to shop seconds after credit approval rather than waiting on a physical card to arrive in the mail.

“The TreviPay mobile app has already seen strong uptake and success for our in-store B2B customers in the first few weeks post-integration,” says Ian McKillop, director of retail technology and delivery at Staples Canada.

“By enhancing the B2B purchasing experience at the point of sale, we continue to elevate technology to empower our customers and drive repeat visits in store.”

The TreviPay mobile app has already seen strong uptake