M&A

Global M&A payments sector deals in Q2 2021

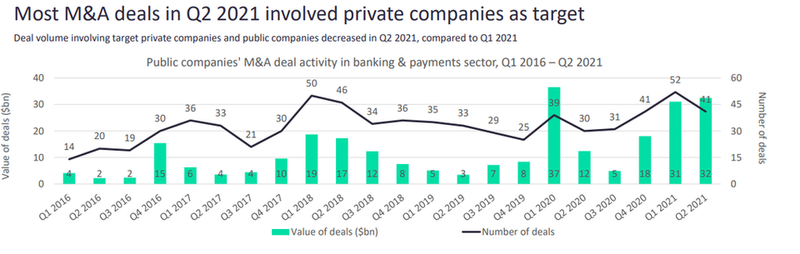

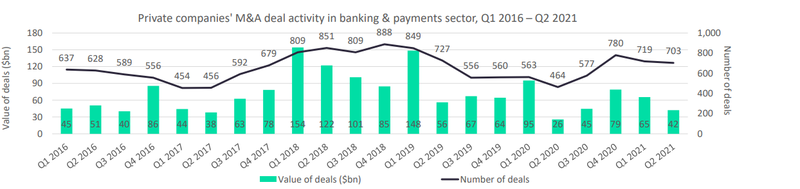

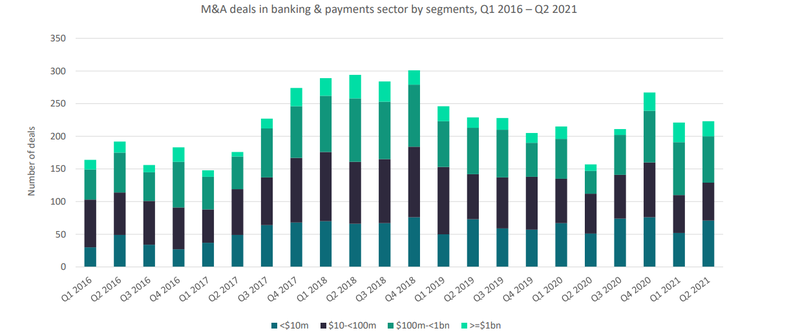

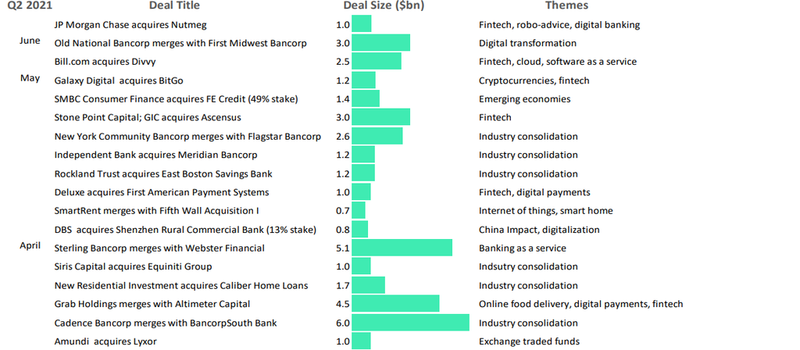

M&A activity in the global banking and payments sector in the second quarter of 2021 reached $106bn, but M&A deal volume marginally dropped to 831, from 845 in the previous quarter, reports Douglas Blakey

S

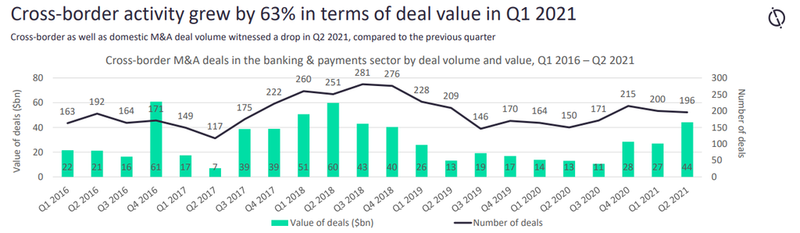

econd-quarter key highlights include cross-border M&A activity. It dominated deal making in terms of deal value in the second quarter of 2021, with cross-border activity up 63% in terms of deal value.

On the other hand, the global M&A market saw 23 billion-dollar M&A deals in the second quarter of 2021, compared to 30 in the previous quarter.

Source: GlobalData

Source: GlobalData

Source: GlobalData

Retail banking and lending is the largest sub-sector, recording a 22.3% jump in M&A deal volume. Fintech is the fastest-growing sector, with a 99.4% increase in M&A deal volume.

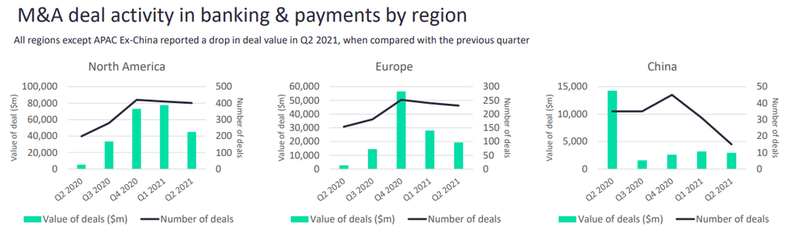

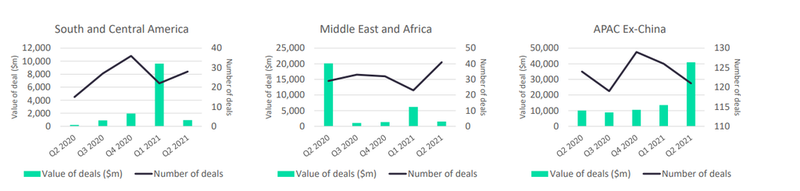

All regions except Asia-Pacific excluding China report a drop in deal value in the second quarter of 2021, when compared with the previous quarter.

Notable second-quarter deals include JPMorgan Chase's acquisition of Nutmeg. The deal enhances JP Morgan’s digital wealth capabilities, as well as kickstarting its consumer business in the UK. By value, however, this is dwarfed by the $2.5bn deal involving Bill.com and Divvy.

Source: GlobalData

Source: GlobalData

Notable industry consolidation deals include Sterling Bancorp and Webster Financial and Cadence Bancorp and BancorpSouth Bank. Other deals worthy of mention include New York Community Bancorp merging with Flagstar Bancorp in a deal worth $2.6bn.

The deal provides the new firm with a diversified revenue stream and allows the scaling up of technologies which will be necessary in an era of technological disruption.

And a $1.1bn deal involving Rockland Trust and East Boston Savings will allow the banks to expand their geographic coverage while also using the newfound scale to broaden their product offerings.

Source: GlobalData