products

Fast-growing Canadian BNPL market hots up

A growing number of banks are entering the Canadian buy-now-pay-later market, spurred on by the growth of foreign and domestic providers in Canada targeting the fast-growing BNPL sector, reports Robin Arnfield

W

hile fintech competitors are bringing new technology, enhanced customer experience, and innovative credit-scoring, the incumbent banks enjoy the advantage of an established consumer and merchant customer base.

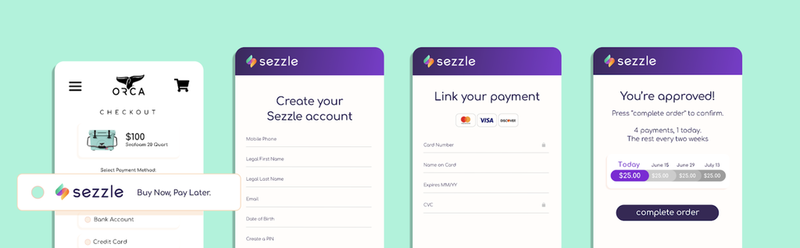

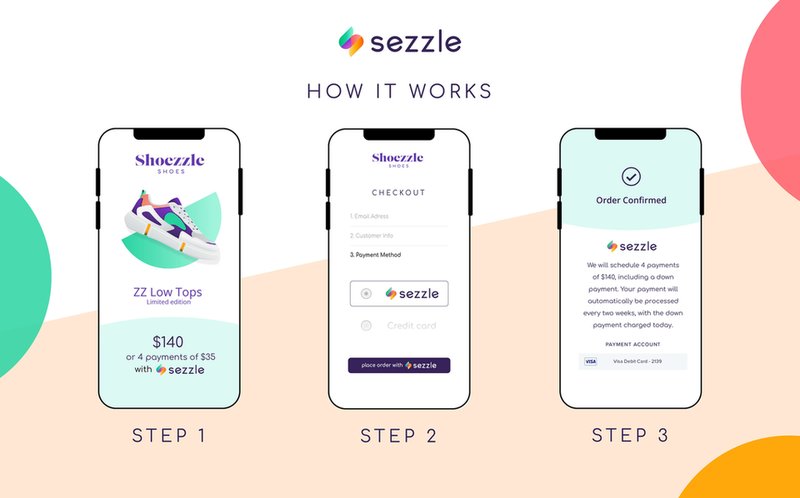

Buy Now Pay Later (BNPL). Image: Sezzle

The Canadian BNPL market is forecast to boast 41% annual growth to reach a value of $3.6bn in 2021. Meantime, for the seven year period to 2028, the Canadian Lenders Association projects an annual CAGR of 14.7%. Such growth will result in gross merchandise value hitting $9.4bn by 2028.

It comes as no surprise then that the BNPL market in Canada is hotting up.

BNPL providers such as Australia’s Afterpay, Canada-based PayBright, and US-based Sezzle have shown that there is a Canadian demographic that prefers short-term instalment loans to revolving credit card debt.

“Short-term instalment loans are attractive to younger Canadian consumers who either lack credit cards or prefer not to build up revolving debt,” says Steve Croth, Managing Director of Zip Canada.

Millennial appetite for BNPL was revealed in a Canadian consumer payments survey conducted in April 2021 by Technology Strategies International. “The 18 to 34 age group accounts for 58% of all Canadian online BNPL users”, says Christie Christelis, the Canadian consultancy’s president. In the twelve months to April 2021, 10% of adult Canadians - 12.5% of online shoppers - had used online BNPL, he says.

“BNPL is Gen Z and Millennials’ preferred way to pay, and, as this generation matures and their spending power grows, so will the use of BNPL as a primary form of payment,” says Ryann Carrathurs, Afterpay Canada’s General Manager. “We expect the use of BNPL to continue in Canada long-term.”

Shift to debit from credit cards

A preference for BNPL goes hand in hand for debit card usage. “Millennials are turning away from the traditional credit card model with annual fees and very high interest rates,” Zip’s Croth says. “Young people don’t have credit cards, just debit cards.”

According to the Canadian Lenders Association, Canadians under 25 tend to use credit cards at far lower rates than older demographics.

Typically, Canadians using BNPL services prefer to make their instalment payments with debit cards or bank transfers rather than credit cards. “Debit cards are used by 80% of people to pay their BNPL instalments,” says Croth.

According to Payments Canada’s “Canadian Payment Methods and Trends 2021” report, the emergence of BNPL lenders that integrate themselves into e-commerce platforms, offering instalment plans online and in-app as checkout options, is shifting Canadian credit card transaction volumes. “BNPL lenders are especially appealing to Canadians who either carry a revolving credit card balance, or don’t have a credit card at all,” the report says.

Canadian credit card balances, which had been rising on average by over 20% a year since 2000, fell from C$90.6bn in February 2020 to C$74bn in January 2021, according to Statistics Canada.

Currently, BNPL products offered by Canadian banks such as CIBC, RBC and Scotiabank are tied to credit cards, with RBC also offering a non-card-based online BNPL program. This means that banks risk being disintermediated by the move to debit-based BNPL.

“As the majority of BNPL repayments are made with debit cards, the banks are losing interchange on credit card purchases as well as brand exposure and visibility to consumers,” says Ginger Schmeltzer, a Strategic Advisor at US-based consultancy Aite-Novarica.

Banks also risk losing customer and merchant data from card transactions, which would enable them to cross-sell products to their cardholders.

Ginger Schmeltzer, a Strategic Advisor at US-based consultancy Aite-Novarica

Market entrants

Over the last few years, foreign BNPL providers such as Afterpay, Klarna, Sezzle and Australia’s Zip Co have entered the Canadian market, and Australia’s Humm also plans to establish a Canadian operation. While they may make soft credit checks from credit bureaux, these companies rely on extensive alternative data sources to assess the creditworthiness of borrowers.

Currently, the Canadian market leader is PayBright, which was bought by US-based Affirm for C$340m in January 2021. Afterpay, which was recently acquired by Square, and Sezzle are also major BNPL players in Canada.

In February 2021 Canadian instalment loan provider Flexiti Financial was bought by US-based CURO Group for C$155m. Flexiti came twelfth in the Globe and Mail’s 2021 Report on Business ranking of Canada’s Top Growing Companies, with three-year revenue growth of 3,181% between 2017 and 2020.

These companies have succeeded in signing up merchants who are willing to offer 0% APR instalment loans to customers in order to increase their conversion rates and shopping basket size.

The permanency of BNPL is demonstrated by the growing number of Canadian retailers adopting the service, says Afterpay’s Carrathurs. “We’ve had a number of major new merchant launches recently including Revolve, Volcom, Crocs, and JD Sports, and our retailers are taking us into new verticals, including kitchen and home, home furnishings, athletic equipment, travel, and big box ‘everyday’ spend retailers,” he says.

Patrick Chan, Sezzle Canada’s General Manager, agrees. “Many different categories of Canadian retailers from traditional retailers to direct-to-consumer e-commerce sites now accept BNPL and see it as a need for their customers,” he says.

Patrick Chan, Sezzle Canada’s General Manager

The banks’ response

CIBC, RBC and Scotiabank have responded to the competitive threat from BNPL providers by launching post-purchase instalment plans on their credit cards. These programs enable cardholders to obtain instalment loans on their card, for example through their bank’s mobile app, after they have made purchases.

This is an easy option for credit cardholders, since they don’t need to apply for a new BNPL account with a separate line of credit. Repayments are included in their credit card’s minimum monthly payment, and customers receive credit card rewards on BNPL purchasers. However, credit card-based instalment programs don’t reach customers who don’t use credit cards.

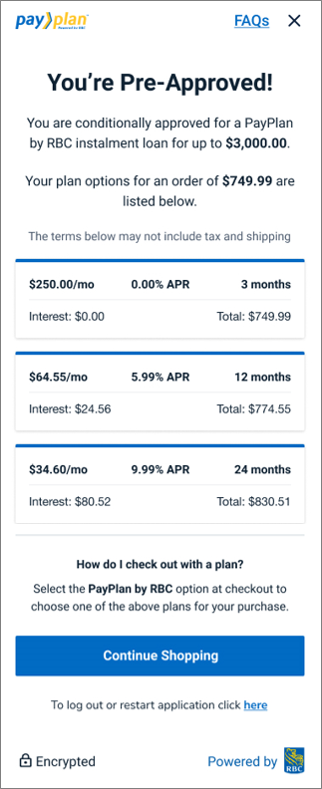

Another disadvantage of these credit card programs is that, because they are post-purchase, they aren’t offered by merchants at the point of sale, although RBC has also launched PayPlan, a non-card-based online BNPL programme which is offered by RBC’s merchant clients. Customers are given the option to apply for PayPlan by RBC in the checkout flow of any participating retailer in order to pre-qualify.

PayPlan by RBC

“The challenge for banks is to make their instalment payment plans as easy as it is to set up a loan with Afterpay or Klarna, for example,” says Aite-Novarica’s Schmeltzer. “Consumers love BNPL as it’s as easy to pay with instalments as it is to pay upfront. You provide Afterpay with four pieces of information and it takes a second to do the underwriting process. Then you have to input your debit card information and Afterpay charges your card every two weeks for the purchase.”

For smaller banks wishing to offer credit card-based instalment plans, one option is to use a third-party issuing platform which includes BNPL programs. Canadian fintech Brim Financial issues Mastercard-branded credit cards offering instalment loans and also provides its technology on a white-labelled basis to FIs and other partners, enabling them to easily roll out credit cards offering BNPL.

Canadian Western Bank is the first Canadian FI to issue white-labelled credit cards offering instalment loans on Brim’s platform. “We see significant pickup in BNPL usage on our own cards and across our partners,” says Brim’s CEO Rasha Katabi. “That tells us that BNPL is becoming a lot more mainstream, and it is a payments mechanism that is going to become more and more standard in North America.”

Visa Installments

Visa Canada’s announcement of the Visa Installments platform in June 2021 opens up new opportunities for banks. Leveraging its merchant acquirer and bank relationships, Visa Canada plans to help its issuers take advantage of consumer demand for instalment plans.

Brian Weiner, Visa Canada’s Vice President of Product and Digital

Brian Weiner, Visa Canada’s Vice President of Product and Digital, estimates that instalment payments adoption has increased by 30% in the last year in Canada.

Visa Installments, which enables Visa cardholders to turn purchases into instalment payments, requires participation by merchants and their acquirers.

Currently, Visa Installments is only available for Visa-branded credit cards in Canada, but Visa plans to extend the platform to cover debit cards for online and cross-border purchases.

Issuers offering Visa Installments can enable their cardholders to set up instalment payments plans at the point of purchase, rather than later on. The platform also includes a post-purchase capability.

“In markets where BNPL has taken off, it’s because people are making a during-purchase decision to conduct an instalment transaction as opposed to a post-purchase decision,” says Weiner.

The advantage of Visa Installments to participating online and in-store merchants is that they are able to offer customers a range of instalment options on their physical POS screen or e-commerce checkout. These offers are predetermined by the issuer and the merchant.

“For example, the merchant can offer the cardholder 0% APR for an instalment loan, in which case the merchant will pay the interest to the issuer,” says Weiner. “An alternative to an interest-free loan would be for the cardholder to pay interest to their issuer.”

Visa Installments gives participating card issuers an advantage over pureplay BNPL providers who currently can only offer instalment loans at the physical point of sale by providing their customers with virtual cards held in mobile wallets.

Merchants need to be signed up for Visa Installments by their acquirer using Visa’s instalment payment APIs. The first acquirer to announce support for Visa Installments in Canada is Global Payments which will roll out the platform to its Canadian merchant base this Autumn. “We aim to bring on the other Canadian acquirers and technology enablers to roll out our solution to their merchant base,” Weiner says.

In October 2021, Visa announced that Moneris, a joint venture between RBC and Bank of Montreal, will offer Visa Installments to its Canadian merchants in Spring 2022.

Scotiabank is the first Canadian credit card issuer to go live with Visa Installments. In August 2021, Scotiabank launched Scotia SelectPay which gives customers the option to convert in-store or online purchases made on their credit card into smaller instalment payments, while still earning rewards on their purchases. Currently, Scotia SelectPay can only be used post-purchase, with cardholders converting eligible purchases to a Scotia SelectPay plan using their Scotia mobile banking app or online.

Visa Canada has signed up two other Canadian credit card issuers, Desjardins and CIBC for Visa Installments. It is also working with issuer-processor i2C, Equinox Payments, and Worldpay from FIS to enable Visa Installments in Canada.

“In Canada, Visa Installments is beginning with credit cards,” says Weiner. “We have a big share of the Canadian debit card market with Visa Debit, so we will extend out to debit eventually.”

Canadian debit cards can be co-branded with Interac and Visa Debit or Mastercard Debit. However, Visa Debit and Mastercard Debit can only be used for online purchases or for point-of-sale purchases abroad, as Interac is the sole POS debit scheme in Canada.

Weiner expects that over time issuers will offer Visa Installments across the entire Canadian Visa credit and debit card base. “Every issuer will have their own strategy as to how they deploy the solution, whether just for online purchases, as is the case with CIBC’s Visa Installments product (due for launch in early 2022), or for both online and in-store,” he says.

With Visa Installments, no credit checks take place at the point of sale and the instalment loan is taken out of the cardholder’s existing credit line from their issuer. “This means that the cardholder doesn’t have to apply for a BNPL account,” says Weiner.

Mastercard announced its Mastercard Installments platform in September 2021, which will be launched in Australia, the US and the UK in Q1 2022, with other markets to follow. However, Mastercard hasn’t said when the program will be available in Canada.

Technology Strategies International’s Christelis says that Canadian domestic debit scheme Interac won’t want to be left out of the BNPL market. “Interac is positioning itself for a future where it competes more aggressively with the credit card companies,” he says.

Debbie Gamble, Interac’s Chief Officer, Innovation Labs and New Ventures, says the company is looking at BNPL for physical and digital payments as part of its ambition to deliver an enhanced experience for Interac debit cardholders.

CIBC

CIBC launched its CIBC Pace It instalment program for eligible CIBC credit cards in September 2019, enabling customers to select an instalment payment plan after they have bought an item, via the CIBC mobile app or online banking. In early 2022, CIBC will launch instalment plans on its credit cards using Visa Installments, enabling customers to opt for instalment payments at the time of purchase for online shopping only.

“Pace It gives clients greater flexibility and lower interest rates for large, planned purchases or unexpected events,” says Jeffrey Smith, CIBC’s Vice President, Card Products, Personal Banking Products. “For example, if a client lacks the immediate funds to enhance their home office space, Pace It provides an opportunity to fund this purchase at a lower interest rate and spread-out payments in a timeframe suiting their needs. Interest rates range from 5.99% to 7.99%, which is less than their credit card’s annual interest rate.”

Monthly payments appear as part of the minimum payment amount due on the credit card statement. If a payment is missed, that instalment is charged at the credit card’s regular rate, while the remainder of the plan continues in effect.

Smith said that, during the pandemic, Pace It has been used for larger-ticket items such as home renovations and improvements, and now travel usage is beginning to pick up. “While there has been strong uptake in Pace It amongst millennial clients, usage is also coming from other demographics,” Smith says.

Customers can use Pace It for minimum purchase amounts of C$100. “Pace It doesn’t have merchant fees and is merchant-agnostic,” says Smith. “The instalment plan is created by our client after a purchase, through CIBC online or mobile banking. There’s no involvement by the merchant in setting up the plan.”

“With the Visa Installments solution, eligible Canadian CIBC cardholders will be able to request an instalment option at the online checkout stage of their shopping experience,” says Smith. ‘This new offering will be available to most CIBC personal credit cardholders on qualifying purchases at participating merchants.”

RBC

RBC launched its PayPlan BNPL product for high-value purchases in Canada in January 2021, using technology from Alliance Data subsidiary Bread. PayPlan can only be used for online purchases, and consumers can only pay for PayPlan loans from their bank accounts.

Amit Sadhu, RBC’s VP Personal Lending and Newcomer Segment, says the bank is marketing PayPlan to its merchant clients, especially smaller merchants. “RBC has a third of the Canadian merchants as business banking customers,” he says.

RBC’s VP Personal Lending and Newcomer Segment

PayPlan offers interest-bearing loans, where consumers pay the interest, and interest-free loans, where merchants fund the loans. Where the customer pays interest on their PayPlan loan, the rate is generally lower than credit card interest rates, says Sadhu. “We don’t charge borrowers any hidden fees,” he says.

Sadhu says RBC has noticed that, where PayPlan merchants offer interest-free loans, the cart conversion rate increases, the average ticket size is higher, and the repeat customer rate is higher.

RBC acquires PayPlan customers via the merchants that offer the financing program, which can also be used by non-RBC customers. Over half the consumers signing up for PayPlan aren’t RBC customers, Sadhu says. “It is younger customers, predominantly millennials, who use PayPlan,” he says. “Our users have above-average income and above-average credit scores, so they are good credit risks. We’re able to cross-sell other consumer products to our PayPlan clients, given their credit and income profile.”

PayPlan has several benefits to consumers, Sadhu says. “Firstly, you avoid getting into debt with revolving credit card loans, as PayPlan is a term loan,” he says. “Also, the costs are lower for consumers compared to credit card loans, and often PayPlan loans are interest-free. For example, BestBuy and EB Games offer interest-free PayPlan loans to shoppers.”

RBC began looking at BNPL in 2019, Sadhu says “BNPL was non-existent in Canada then. But we saw that it was getting big in Australia, which is a very similar market to Canada in terms of population, a limited number of big banks, and five big cities having the majority of the population. As we saw companies such as Afterpay quickly gain market share, we developed our strategy for the BNPL space.”

RBC’s attitude is that it will always offer merchant and consumer clients the solutions they want, says Sadhu. “If they want traditional credit cards, we will offer these. If they want instalment payments on credit cards, we will provide this, and, if they want non-card-based instalment solutions, we will offer that too,” he says.

When RBC’s own customers apply for PayPlan loans, it has access to their RBC credit history. RBC does a credit bureau check when non-RBC customers apply for a PayPlan loan. “We don’t hide these credit checks from the bureaux,” Sadhu says. “Currently, we don’t report PayPlan loans to the credit bureaux, but we’re working with the bureaux to find the right way to report these loans.”

Sezzle

Image: Sezzle

Sezzle has experienced rapid growth since it entered the Canadian market in 2019, says Sezzle’s Chan. The company currently has 3,000 Canadian merchants, and serves 10,000 merchants for cross-border US-to-Canada and Canada-to-US purchases.

“Sezzle’s average transaction is C$140, so we’re acting like a credit card alternative,” says Chan. “Just over 60% of our Canadian customer base is aged between 18 and 34. They use Sezzle because they don’t want to build up revolving credit card debt or they don’t have a credit card.”

Sezzle assesses the credit of credit-invisible customers who lack a credit history by analysing alternative data via a proprietary algorithm, instead of pulling a credit score.

In the US, Sezzle is the only BNPL provider to provide a credit building tool enabling customers to build their credit record. “Sezzle doesn’t offer this tool in Canada yet,” says Chan.

Zip

Zip established its Canadian operation in March 2021, having entered the US through the acquisition of Quadpay, now rebranded as Zip. “We’re importing our US merchant portfolio into Canada for cross-border shopping from Canada to the US,” says Zip’s Croth. “Canadians love to shop cross-border, and 90% of Zip’s Canadian volumes are for cross-border purchases from the US.”

Generally, Zip’s merchants charge 0% interest for instalment loans. But, where there is pressure on a merchant’s margins, Zip gives merchants the option of charging C$1 per instalment payment.

Croth says Zip uses alternative data for its loan decision engine. “We do an instant credit check plus a background check, and look at the customer’s device, email address and cellphone number,” he says. “This is very different from the traditional way of evaluating loans where you look at the borrower’s income and ability to make repayments. Our purchases typically average C$200-C$300 which the borrower pays off over six weeks. The risk and decisioning is different to someone spending C$15,000 in a furniture store and paying it back over a year.”

Regulations

Currently, fintech BNPL providers aren’t federally regulated in Canada, nor are they required to report loans to credit bureaux.

The Financial Consumer Agency of Canada (FCAC) oversees federally regulated financial institutions’ (FRFI) compliance with consumer lending protection provisions in federal legislation and regulations. “For example, FRFIs must comply with requirements related to disclosure, minimum grace periods, debt collection practices, and express consent,” an FCAC spokesperson says. “These requirements could also apply to loans that FRFIs provide as BNPL products.”

In May 2021, Dr Supriya Syal, the FCAC’s Deputy Commissioner, Research, Policy and Education, said the regulator is reviewing BNPL as an emerging consumer trend. She said the FCAC’s concerns revolve around the risk of overborrowing from BNPL lenders, negative impact on credit scores, and lack of recourse through a complaints-handling procedure.

“All are drawbacks which are poorly understood by consumers and can have wide-reaching consequences,” Syal said. “For instance, according to FCAC research, one in five people (18%) said they spent more using a BNPL service than they otherwise would have with a different payment method (with 8% saying they spent ‘much more’).”

With the UK’s Financial Conduct Authority due to introduce regulations for BNPL, the FCAC is likely to eventually introduce regulations.

“Regulators in different countries are looking at BNPL,” says Aite-Novarica’s Schmeltzer. “Many people have raised concerns about how BNPL loans are being underwritten and how they are managed and worked out overall. Regulators are concerned about how consumers are staying on top of their BNPL debt and whether they will be hit by late fees.”