PRODUCTS

Canada tackles payments modernisation, open banking

Canada’s banking industry faces challenges as it enters a period of major transformation with the implementation of real-time payments and open banking. Robin Arnfieldreports

There is broad support among Canadian banks and Canada’s largest political parties for banking and payments industry reforms but there are major hurdles ahead: most importantly the slow pace at which supportive legislation is being introduced.

Although Canada’s instant payment system, the Real-Time Rail, is due to be launched in late 2021, under current payments regulations, non-bank PSPs will not be able to access it directly. As a first step, the Retail Payments Activity Act has been introduced to provide regulatory oversight of non-bank PSPs in Canada and to facilitate greater participation in the country’s core retail payment systems by paytechs. Additional legislation will be needed to ensure paytechs can directly access these systems.

Canada’s financial services industry is dominated by a small number of banks, resulting in limited competition. However, there is political pressure to open the market to the growing number of Canadian paytechs so that Canadians can have access to more innovative and cheaper services.

Canada currently lacks any open banking legislation, although a stakeholder consultation by the Department of Finance has recommended the introduction of open banking by 2023. However, the proposed open banking system focuses on data-sharing and lacks plans for payments initiation. So far, there is no legislation giving consumers the right to financial data mobility so they can move their data from one institution to another.

Payments modernisation

Canada’s core clearing and settlement systems are operated under the Canadian Payments Act by Payments Canada, a non-profit body representing its member FIs. At the end of 2020, there were 111 members, all deposit-taking institutions.

In 2015, Payments Canada embarked on the modernisation of Canada’s payments infrastructure to make it easier for consumers and businesses to pay and transfer money from their bank accounts.

Currently, Canadians can either set up preauthorised fund transfers, which take place overnight via Payments Canada’s batch payment system, the Automated Clearing Settlement System; or use Interac e-Transfer, which has limits on the daily amounts that can be transferred by consumers and businesses. e-Transfer, which offers near-real-time payments, is operated by Canadian debit scheme Interac.

Open Banking System's phases

The Real-Time Rail

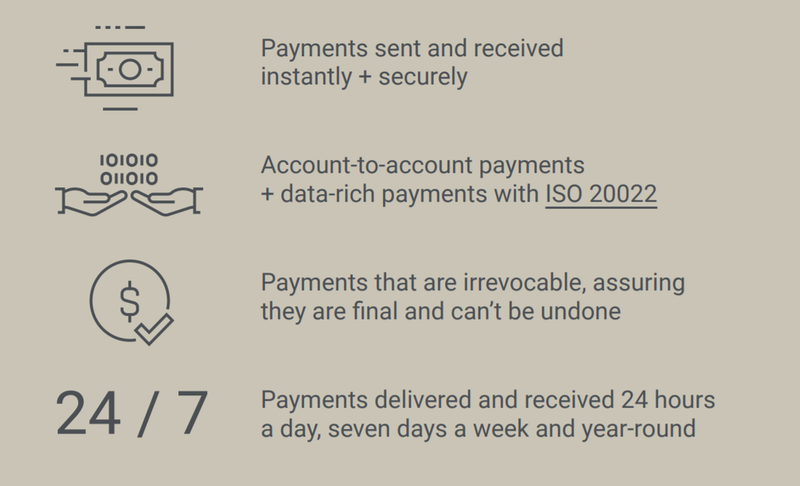

In late 2022, Payments Canada will introduce the Real-Time Rail as the key element of its modernisation programme. The RTR will be based on clearing and settlement infrastructure from Mastercard’s Vocalink subsidiary and will incorporate the ISO 20022 payments messaging standard to provide rich transaction data.

Integrating ISO 20022 will support the introduction of new payment services overlaid on the RTR, as well as the digitalisation of manual and paper-based processes for invoicing and payment reconciliation.

Interac will supply the payments messaging exchange platform for the RTR, leveraging the technology underlying e-Transfer. The RTR Exchange will enable participating FIs to exchange payments transactions and related messages with each other.

“Once we’ve finalised the RTR’s design, we’ll start building the new system,” says Andrew McFarlane, Payments Canada’s Executive Director of Modernisation. “We’re committed to launching the RTR in Autumn 2022. Our member FIs are currently conducting a range of impact assessments to see what the new system will mean and what the dates are which they can work to for delivery.”

Andrew McFarlane, Payments Canada’s Executive Director of Modernisation

e-Transfer will be the first payment service to be overlaid on the RTR. “There’ll be a large number of overlay services built on the RTR,” says McFarlane. “Request to Pay, which can be used for bill and invoice payments as well as consumers requesting money from each other, will be an important RTR use case.”

Other use cases could include emergency government disbursements to citizens’ bank accounts; insurers making emergency disbursements for claims; and employers paying gig economy workers in real-time at the end of their shift.

Access

Paytechs will not have direct access to the RTR, since, under the Canadian Payments Act, only deposit-taking FIs can become Payments Canada members and enjoy direct access to its core infrastructure. Consequently, non-bank PSPs will access Payments Canada’s payments systems such as the Automated Clearing Settlement System and the RTR via a Payments Canada member.

Giving non-bank PSPs direct access to the RTR will require changes to the Canadian Payments Act, a move which is supported by Payments Canada. “It’s critical for Payments Canada to ensure we safely open our systems including the RTR to PSPs that aren’t currently Payments Canada members,” says McFarlane. “We want to see an environment where non-bank PSPs can participate and compete.”

In an important first step, the government drew up the Retail Payment Activities Act (RPAA), which received Royal Assent in June 2021. The Act, which is in the process of being implemented, aims to create an oversight framework for non-bank PSPs providing retail payments services.

Prior to the RPAA, non-bank PSPs weren’t subject to regulatory oversight other than being required to comply with Canadian AML regulations. Under the RPAA, non-bank PSPs will have to register with and be regulated by the Bank of Canada.

The RPAA will require non-bank PSPs to maintain risk management and incident response frameworks to identify and mitigate operational risks and to respond to incidents. “The Bank of Canada will supervise PSPs around their operational risk management and end-user fund safeguarding practices,” a Bank of Canada spokesperson says. The central bank will also maintain a public registry of regulated PSPs.

“The RPAA is critical to supporting Payments Canada’s expanding access to our national payments systems,” says McFarlane. “However, changes to the Canadian Payments Act are also needed to broaden access.”

Interac e-Transfer for Business

As a precursor to the RTR, Interac and 13 Canadian FIs launched Interac e-Transfer for Business in August 2021. Based on the existing e-Transfer P2P payments system, the new service provides businesses with real-time payments and instant confirmation.

e-Transfer for Business leverages ISO 20022-based payments messaging data for easier transaction reconciliation and offers a transaction limit of C$25,000, compared to C$10,000 for the existing e-Transfer service. Users can send funds directly to the bank account numbers of recipients that they have on record; or to the traditional e-Transfer payment routing options of email address or mobile number.

ISO 20022

In order to reduce the work Lynx members had to do, Payments Canada decided to go live with Lynx using the existing SWIFT MT message set used by Canadian banks. In November 2022, Lynx will be upgraded to support ISO 20022 in order to allow for data-rich payments.

“We feel we need ISO 20022 adoption from a global interoperability perspective, and we want Canada to be fully consistent and competitive with the rest of the global payments infrastructure,” says McFarlane. “Bringing in the full ISO 20022 message set is important, as we will have enhanced remittance data and a reduction in paper-based payments.”

Payments Canada plans to upgrade its retail batch payments network to ISO 20022. “This will provide real benefits for users, particularly corporates,” says McFarlane. “We’ll ensure that anything we introduce in the future, fully supports ISO 20022.”

Canadian banks are very familiar with ISO 20022 and some of their multinational corporate clients already transact in ISO 20022, says McFarlane. ISO 20022’s challenge for banks is about how they will ingest the substantial amount of data that will flow through with payments and how they will display it to their customers, he says.

Cross-border payments

Currently, Payments Canada only deals with domestic payments. When Payments Canada conducts Canadian consumer research, consumers identify cross-border payments as the number one friction point.

“It’s a challenge for many people to send money offshore seamlessly,” says McFarlane. “Cross-border payments is an unmet need for us and part of our vision for the Canadian payments ecosystem. We definitely want to offer cross-border payments in due course.”

Open banking

Canada’s biggest parties, the Liberals and the Conservatives, are championing the implementation of open banking as they want to see better and cheaper banking services available to Canadians.

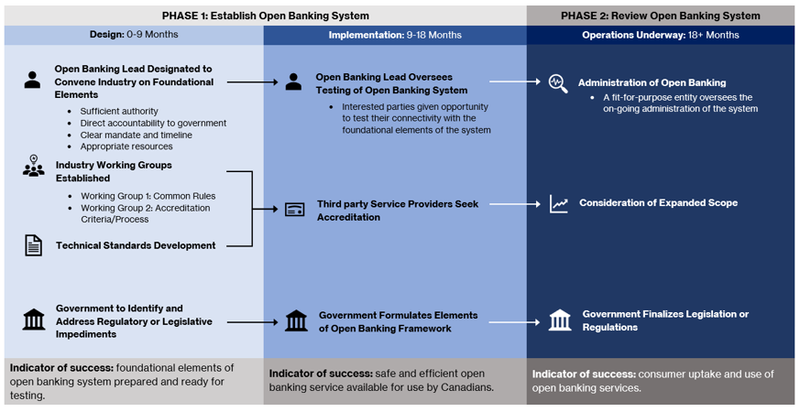

In August 2021, the Department of Finance published the final report from the Advisory Committee on Open Banking, which drew up a roadmap leading to the implementation of phase one of open banking by January 2023.

Senator Colin Deacon, an advocate for opening banking in Canada, is concerned about the risk of delay. “For open banking to happen in Canada, the government needs to make it a priority,” says Deacon. “Canada is lagging behind other countries in open banking, and the modernisation of its banking and payment systems is very slow.”

Replacing screen-scraping

The introduction of open banking is necessary because of the wide use of screen-scraping by Canadians as a means of linking their accounts at different FIs. Over 4 million Canadians currently access fintech services such as personal budget planners, robo-advisors, and non-traditional lenders via screen-scraping.

The Department of Finance’s report says screen-scraping presents “security and liability risks,” as it requires consumers to share their banking login credentials with third-party providers.

Introducing open banking in Canada using APIs to enable customer data-sharing between banks and fintechs will provide a secure and regulated alternative to screen-scraping, the report says.

The initial phase of open banking should mandate participation by all federally-regulated banks and include data available to consumers and small businesses through online banking applications as well as consumer data held by third-party service providers, the report recommends.

Deacon says open banking will increase competition as it will enable consumers to access innovative services from fintechs that their banks don’t currently provide. “Consumers could really benefit from fintechs that use AI to analyse their financial data and offer ways to reduce their debt load, improve their credit score, or make more cost-effective investments, for example,” he says.

Liability

A critical prerequisite for open banking is the establishment of security guidelines and a liability framework to ensure customer data is protected, and, in the event of breaches, the parties responsible are identified.

The report recommends that the open banking system should be based on common rules for participants, to ensure consumers are protected and liability rests with the party at fault. An accreditation framework and process should be established to allow third-party service providers to enter the open banking system, along with technical specifications allowing for safe and efficient data transfer.

Governance

The report calls for the appointment of a lead, accountable to the Department of Finance, who would work with stakeholders to design and launch the open banking system. The lead would then hand control to a purpose-built governance entity including bank and consumer representatives to administer open banking. In addition, the government should consider the need to formally codify some elements of open banking in legislation.

Open banking accreditation process for third-party service providers will require the establishment of a trusted directory framework to check the identity and compliance with the specifications of all participants in the open banking ecosystem, says Eyal Sivan, Head of Open Banking at enterprise software vendor Axway.

Eyal Sivan Head of Open Banking at enterprise software vendor Axway

"This will help with liability,” says Sivan. “If you don’t have a trusted directory framework, it’s difficult to trace what happened when something goes wrong and identity the parties who are responsible. But liability is technically difficult to implement. Not only do you need specialised governance around a liability framework, but you need technical standards to trace accountability across the whole ecosystem. Many regions which have adopted open banking are struggling to build an enforceable liability framework.”

FDX establishes API-based common standards

Deacon says that, instead of waiting for the open banking governance entity to be established, Canada’s banks should implement multilateral commercial agreements with fintechs. “The banks and fintechs should based their commercial agreements on the recommendations of the report and use existing open banking standards such as those developed in the EU or in North America by bodies such as FDX,” he says. “This would provide an opportunity to prototype the open banking system before it’s entrenched in regulations.”

FDX (Financial Data Exchange), which includes Interac and Canadian banks such as BMO, CIBC, Desjardins, RBC and TD as members, has developed API-based common standards for financial data-sharing in North America.

Sivan says a number of the report’s recommendations could be carried out in parallel to drive momentum. “The establishment of the governance body and the technical specifications could happen in parallel, if handled correctly,” he says. “As Canada is following regions which have implemented open banking, a lot of free material is available in terms of API specifications, learnings, sandbox material, and consumer experience guidelines.”

Write access

Alex Vronces, executive director of Paytechs of Canada, is concerned that the report neglects write access. According to the report, Canada’s implementation of open banking should be limited at launch to read access, enabling consumers to share their financial data with fintechs. Write access, enabling consumers to authorise fintechs to act on their data and initiate payments, should be introduced later, it advises.

Vronces says that write access is important, since Canada’s payments infrastructure is being modernised and regulations are being introduced for paytechs. “The plan is to give these paytechs access to the essential payments infrastructure our economy runs on,” he says in a blog. “Industry and government are already doing their respective parts to manage all the risks of seamless money movement. So, if now’s not a good time to consider write access, then when is?”

Sivan believes the reason the report didn’t discuss write access, is because it is controversial, given Interac’s dominance. “Interac is owned by the banks and provides a near-real-time payments rail with e-Transfer,” he says. “It gives a great deal of assurance and stability to our banking environment. But, when you introduce payments initiation, you’re providing an alternative payments method to Interac, which is problematic politically. It will be necessary to figure out the relationship between Interac and the bank-to-bank payments initiation mechanism set up in open banking.”

Advisory Committee on Open Banking’s key recommendations

- Consumer data should be protected;

- Consumers should be in control of their data, and should have recourse if issues arise;

- Federally-regulated banks should be required to participate in the first phase of open banking. Provincially-regulated FIs such as credit unions should be able to join on a voluntary basis;

- Chequeing and savings accounts; investment accounts accessible through online banking portals; and lending products such credit cards, lines of credit and mortgages should be included in the first phase;

- Common rules for open banking participants to replace the need for bilateral contracts and ensure consumers are protected;

- An accreditation framework and process to allow third-party service providers to participate;

- Technical specifications allowing for safe and efficient data transfer, and

- The creation of an entity to manage the administration of the open banking system. Governance of the entity should include representation from banks, other open banking participants and consumer representatives.