Request to Pay

Request to Pay to challenge direct debits and payment cards?

Can Request to Pay challenge established payment methods? Request to Pay enables new flexible ways for money to move between people, organisations and businesses. But will a lack of bank readiness impede the adoption of Request to Pay, writes Douglas Blakey

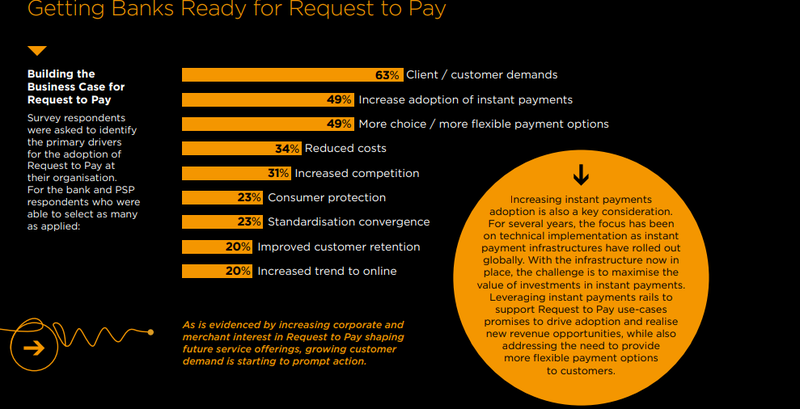

Limitations of existing technology and a lack of clear strategy are just two of the key inhibiting factors that may hamper the growth of Request To Pay. But a new report from Icon Solutions reveals that the industry expects Request to Pay to have a lasting impact on the industry.

Request to Pay is one of the most talked about initiatives in the payment industry at present. In allowing payees to initiate requests for payment within a secure messaging channel, and with the ability for data to travel with the payment request, Request to Pay enables new flexible ways for money to move between people, organisations and businesses.

As such, it can be viewed as an enabling mechanism for a range of different payment scenarios or use-cases. Yet despite broad interest and increasing recognition of its potential to offer new and improved payment services, the path to widespread adoption remains unclear. The full range of product offerings across customer segments have yet to emerge and take hold. To better understand current and future perspectives on Request to Pay, in October 2021, Icon Solutions surveyed a group of over 50 industry stakeholders including leading retail and global corporate banks. In-depth interviews were also conducted with senior executives at several tier 1 banks.

Icon Solutions survey finds that Request to Pay is widely expected to challenge established payment methods, with 87% of respondents viewing it as a good alternative to direct debits and 71% expecting it will reduce merchant’s dependency on payment cards.

Yet 67% also identify bank readiness as the main barrier impacting adoption of Request to Pay services, with the limitations of existing technology and a lack of clear strategy seen as the key inhibiting factors.

Despite early momentum from retail customers for bill payment services, 73% of respondents see most demand for Request to Pay services from large corporates. To reflect this increasing demand, respondents are planning to leverage Request to Pay to diversify product roadmaps, with invoicing, payments reconciliation, and the digitalisation and integration of processes and systems identified as the leading emerging use-cases.

Despite increasing demand for Request to Pay, action is limited.

Some 69% of banks and PSPs surveyed recognise the potential of Request to Pay, but a gap persists between attitude and actions. Few survey respondents had launched Request to Pay services to date and Request to Pay does not feature on the short-term roadmaps for many.

For retail customers, one-off and recurring bill payments are the dominant use cases currently on offer. For corporates and merchant customers, fewer offerings are available and it is e-invoicing that has the most application so far. But in line with increasing demand from corporate customers, respondents plan to offer a wider set of use cases.

The biggest obstacles to industry adoption are bank readiness, strong customer authentication and standardisation.

When considering the industry challenges that need to be addressed for adoption of Request to Pay to build, the top-ranking answer, in line with the state of play on current offerings, was bank readiness (67%). This was followed closely by the need for strong customer authentication (54%) to counter the risk of fraud to build trust and confidence, and then standardisation of message content and exchange (48%) to promote simplicity and interoperability.

Credit: Icon Solutions

Existing technology is limiting banks when it comes to delivering Request to Pay.

Like other transformation programmes, banks’ ability to deliver Request to Pay services to the market is constrained by existing technology estates, including channels, payments processing and core banking systems, as well as the lack of a clear strategy.

Industry adoption: increasing demand but limited action

There is undoubtedly widespread understanding of the benefits that Request to Pay can deliver, with 71% of banks and PSPs surveyed recognising the potential. But this has not yet translated into meaningful action.

Only 18% of bank and PSP survey respondents already offer a Request to Pay service. And despite a recognition of the benefits and customer demand, only a further 12% of respondents plan to launch a service within the next six months and 15% within the next year. A further 32% plan to address this as part of a wider payments transformation project.

Credit: Icon Solutions

Louise Shorthouse, Senior Payments Consultant at Icon, comments: “Make no mistake, the industry expects Request to Pay to have a lasting impact on the future of banking and payments. The potential to deliver more flexibility, choice and control to corporates, merchants and consumers – while reducing costs – offers a real alternative.

For example, Request to Pay opens the ability to circumvent traditional card rails and drive consumers towards cheaper account-to-account (A2A) based payment options at the point-of-sale, and provides an alternative to direct debits that gives customers more flexibility in how they pay bills and manage their finances. If we consider the massive transaction volumes involved, it seems inevitable that Request to Pay will change the way we pay.”

Technology challenges remain, third party partnerships key

Toine van Beusekom, Strategy Director at Icon adds: “Despite the undoubted potential of Request to Pay, technology transformation programmes remain notoriously difficult. Identifying a pragmatic path to upgrade existing technology estates, in tandem with a clear strategy that is aligned with broader business objectives, will be critical to accelerating bank support for Request to Pay services and remaining competitive in the long-term.

But with banks already at the limits of their technological and strategic capacity, trusted third-parties promise to play an important role in filling the resource gap to help banks realise the huge opportunities presented by Request to Pay.”

The full report is available for download at iconsolutions.com.