Patents Data

IoT, ESG innovation among payments sector companies declines in the past quarter

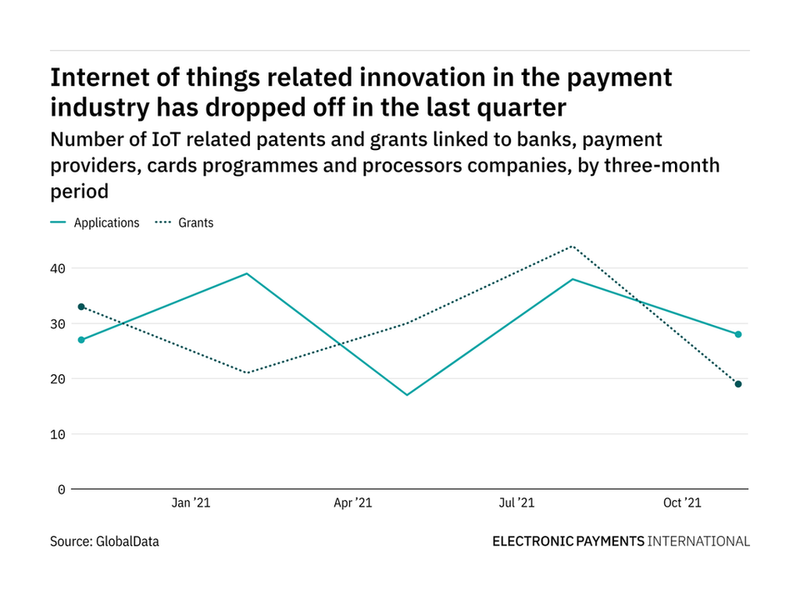

Research and innovation in internet of things in the banks, payment providers, cards programmes and processors sector has declined in the last quarter – but remains higher than it was a year ago, writes Michael Goodier

R

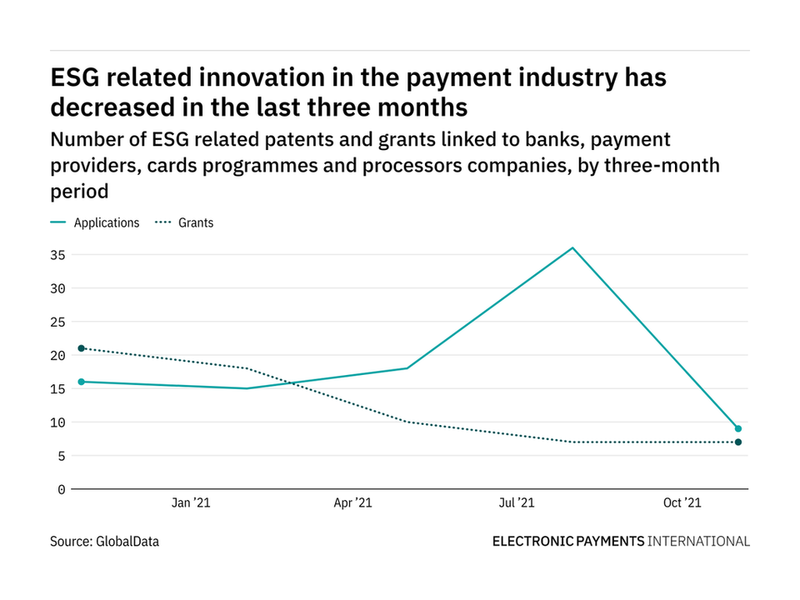

esearch and innovation in environmental, social, and governance in the banks, payment providers, cards programmes and processors sector has also declined.

The most recent figures show that the number of IoT patent applications in the industry stood at 28 in the three months ending November – up from 27 over the same period last year.

Figures for patent grants related to IoT followed a different pattern to filings – shrinking from 33 in the three months ending November last year to 19 this year.

The figures are compiled by GlobalData, tracking patent filings and grants from official offices around the world. Using textual analysis, as well as official patent classifications, these patents are grouped into key thematic areas, and linked to key companies across various industries.

IoT is one of the key areas tracked by GlobalData. It has been identified as being a key disruptive force facing companies in the coming years, and is one of the areas that companies investing resources in now are expected to reap rewards from.

The figures also provide an insight into the largest innovators in the sector.

Capital One was the top internet of things innovator in the banks, payment providers, cards programmes and processors sector in the last quarter. The company filed 30 IoT related patents in the three months ending November. That was up from 14 over the same period last year.

It was followed by Bank of America with 12 IoT patent applications, the US based PayPal (8 applications), and the US based Hartford Financial Services (6 applications).

Capital One has recently ramped up R&D in internet of things. It saw growth of 53.3% in related patent applications in the three months ending November compared to the same period last year - the highest percentage growth out of all companies tracked with more than 10 quarterly patents in the banks, payment providers, cards programmes and processors sector.

ESG patents applications decline

Meantime, the number of ESG patent applications in the industry stood at nine in the three months ending November – down from 16 over the same period last year.

Figures for patent grants related to ESG followed a similar pattern to filings – shrinking from 21 in the three months ending November last year to seven this year.

Again, Capital One was the top environmental, social, and governance innovator in the banks, payment providers, cards programmes and processors sector in the last quarter. The company filed six ESG related patents in the three months ending November. That was down from 10 over the same period last year.

It was followed by the Japan based Shinsei Bank with four ESG patent applications, Bank of America (3 applications), and Barclays (3 applications).