Mastercard, Amex post strong earnings, beat analyst forecasts

So much then for the pandemic and concerns that consumer spending would remain muted. And so much for the never-ending nonsense from certain analysts that ought to know better, arguing that the growth of BNPL would materially impact earnings of the major credit card platforms.

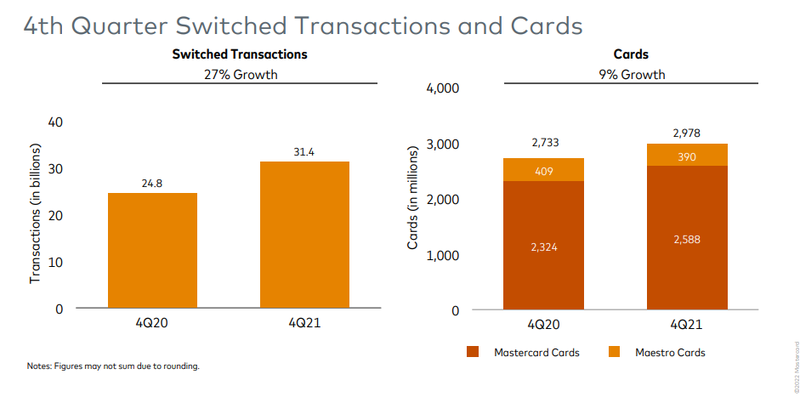

Key metrics from Mastercard highlight that consumer spending is trending up sharply.

Credit: Mastercard

Mastercard Q4 highlights

- Mastercard’s Q4 net income is up by 27% year-on-year to $2.4bn (Q4 2020: $1.8bn);

- This results in full fiscal 2021 net income of $8.7bn, up by 35% y-o-y;

- Q4 cross-border volume growth of 53% on a local currency basis;

- Switched transactions growth of 27%, and

- Other revenues increase by 28%, which includes 9 percentage points of growth due to acquisitions. The remaining growth is driven primarily by the company’s cyber & intelligence and data & services solutions.

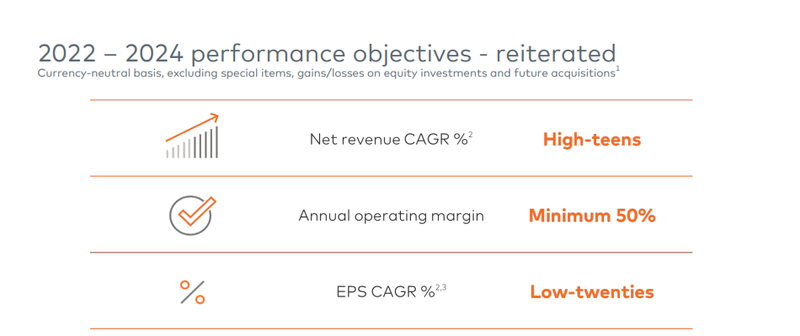

Mastercard reiterates its 2022-2024 performance objectives. Specifically, it continues to target net revenue CAGR% in the high teens and an EPS CAGR% in the low twenties.

Credit: Mastercard

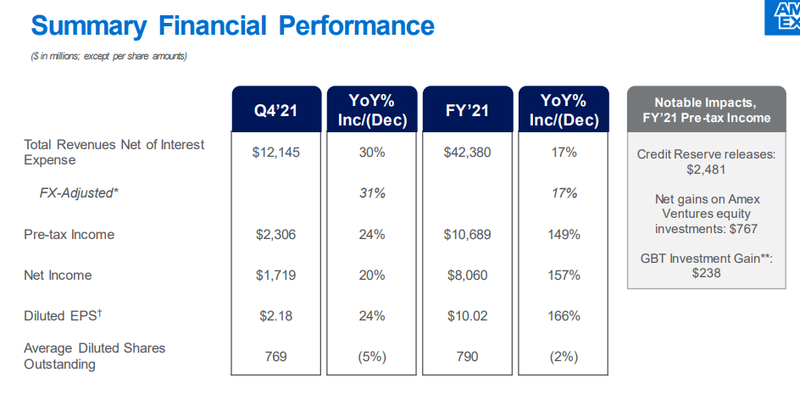

Meantime, American Express fourth quarter earnings are if anything even more impressive than Mastercard. Specifically, Amex reported record credit card spending by users helping net income for the fourth quarter to rise by 19.4% y-o-y to $1.72bn.

Again, Amex key metrics beat analyst forecasts.

Amex Q4 2021 highlights

- Record member card spending helped to boost revenue by 30% to $12.1bn;

- The strong final quarter contributed to a full year rise in revenue of 17% y-o-y;

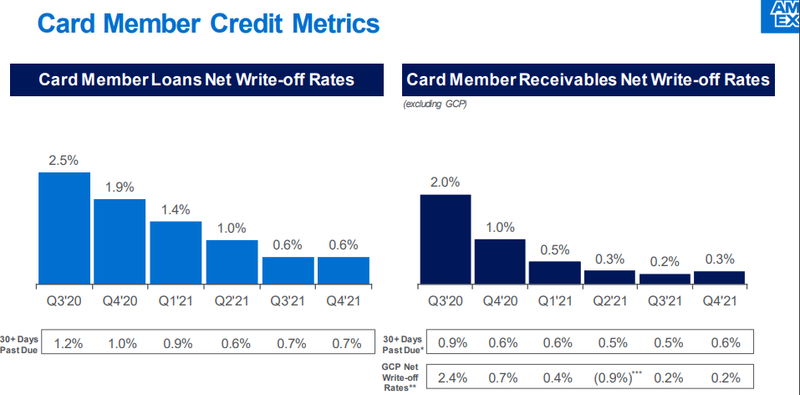

- A net write-off rate of 0.6% down from 1.9% in the year-ago quarter;

- Amex announced plans to increase its quarterly dividend by 20% from the first quarter of 2022, and

- For the full fiscal, Amex posts net income of $8.1bn up from $3.1bn in fiscal 2020.

Credit: American Express

The Mastercard share price of $350 is ahead by 16.7% since the start of 2021.

Over the same period, the Amex share price of $172 is ahead by 42%.

Credit: American Express

BNPL: a sector in trouble?

By contrast, buy-now-pay-later (BNPL) segment share price suggests a sector in trouble. Take Zip for example. Its current share price of A$2.94 is down by 44% since the start of 2021. The current Sezzle share price at A$2.34 is down by 62% over the same period. As Grant Halverson, CEO of McLean Roche tells EPI, Australia has 36 BNPL apps fighting over 73 basis points of the retail payments market with BNPL annual sales volume of A$11.4bn out of total retail payments A$1.56trn.

Zip + Sezzle

Zip and Sezzle would have combined revenues A$465.2m, 9.5 million customers and bad debts of A$131m or 28% of revenue based on 2021 full year accounts.

“With bad debts at 28% of revenue, at this level profits are a futile dream. Sezzle had revenues of A$62.5m 2.2 million US customers and bad debts of A$24.6m.

“But, here is the ‘killer’ – Zip had annual customer revenues of $54.95 while Sezzle has $28.06. A corner store does better and they wouldn’t make massive losses,” concludes Halverson.

Other BNPL share price falls

Humm is currently trading at A$0.82, down by 27.4% since the start of 2021. Payright currently trades at A$0.21 down by 79% over the same period. The Openpay share price of A$0.54 is down by 76% since the start of 2021. And Laybuy’s share price at A$0.21 is down by 84% over the same period.

But despite all of the red ink, it is rare that a week goes by without over-excited PR pitches to this desk, trying to suggest that the BNPL players are poised to steal the market share and profits of the major credit card platforms.