SURVEY

Take a bow Square, PayPal but customer satisfaction declines overall

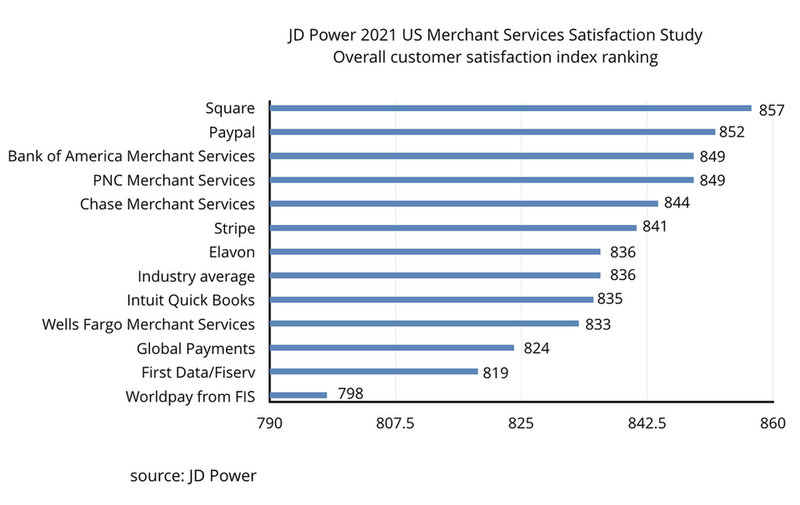

Satisfaction with merchant services providers that enable small businesses to process card and mobile wallet payments has declined from 2020 amid Covid challenges, reports Douglas Blakey. But the JD Power 2021 US Merchant Services Satisfaction Study does provide cheer for Square and PayPal

M

ore than half (51%) of US small businesses acknowledge significant sales revenue declines as a result of Covid-19. And their mood is not helped by declining levels of satisfaction with their merchant services providers.

Challenges with customer service, cost of service, and underwriting and onboarding have been more pronounced among businesses experiencing significant sales declines during the past year.

According to the JD Power 2021 US Merchant Services Satisfaction Study, overall small business customer satisfaction with merchant services providers is 836 (on a 1,000-point scale), down slightly from 2020. Among businesses that cite significant revenue declines due to Covid, the average satisfaction score is 827.

Satisfaction among businesses that have experienced Covid-related disruptions are also significantly lower with contact centre representatives; automated voice response (IVR) services; underwriting and onboarding; and cost of service.

Key findings include:

- Tech performs well, while service suffers: While scores for service-related experiences such as interactions with the contact centre and underwriting and onboarding have declined in this year’s study, overall small business customer satisfaction with technology functionality, reliability and ease of use are among the highest-scoring factors in the study.

- Satisfaction highest among e-commerce merchants: Among all sales channels evaluated, overall satisfaction with their merchant services providers is highest amonge-commerce small businesses (851). This group also has the highest level of understanding of pricing and fees, as well as higher satisfaction with the options and tools available to manage chargebacks. However, satisfaction increases most among small businesses that accept card and digital wallet payments in physical (card present) environments. This year, satisfaction is higher among these businesses in the areas of timeliness of resolving service requests and clarity of pricing and fees.

Square, PayPal top poll ahead of Bank of America, PNC

Squareranks highest in merchant services satisfaction with a score of 857. PayPal (852) ranks second. Bank of America Merchant Services(849) and PNC Merchant Services (849) rank third in a tie.

In the months prior to study fielding, many small businesses experienced unprecedented levels of disruption and change. Along with the effects of the pandemic, some small businesses were introduced to new payment processor brand names resulting from merger integrations at FIS, Fiserv and Global Payments. Some customers of Bank of America Merchant Services experienced the dissolution of the joint venture between Fiserv and Bank of America.

“In recent years, merchant services providers have introduced technology innovations that make it easier than ever for small businesses to accept card and digital wallet payments,” says Paul McAdam, senior director of banking and payments intelligence at JD Power.

“This past year demonstrates that the technology is consistently meeting market needs, but achieving real, lasting customer satisfaction is as much about service levels as it is about technology.

“Payment processors should anticipate that many of the challenges and financial pressures small businesses faced in 2020 will continue to be a factor for the foreseeable future and tailor their customer-facing strategies to address those needs.”

A bar chart of JD Power 2021 US Merchant Services Satisfaction study. Credit: JD Power